The rise in digital wallet usage, contactless payments, and mobile banking reflects a shift in consumer behavior. Convenience and security drive this adoption across various demographics.

In recent years, the financial landscape has transformed dramatically, with technology spearheading a revolution in how consumers manage their money. Digital wallets, contactless payment methods, and mobile banking apps have seen a surge in popularity, underpinned by the demand for faster, safer, and more convenient transaction options.

This shift is not just a trend but a fundamental change in the consumer financial interaction, marking a move towards a digital-first approach. The ease of use, coupled with enhanced security features, has made these digital solutions a staple in everyday commerce, reshaping the way we think about personal finance. As these technologies become more integrated into our daily lives, their impact on consumer habits and the broader economy continues to grow.

The Rise Of Digital Wallets

In an age where convenience is king, digital wallets have emerged as champions of financial transactions. They simplify purchases, bill payments, and money transfers. Users enjoy unprecedented ease and security. Let’s dive into their journey and the latest trends shaping our payment experiences.

Early Beginnings And Evolution

Digital wallets started as a bold idea. They aimed to replace our physical wallets. The evolution began with simple online payment methods. Now, we have sophisticated apps. Each app stores credit cards, loyalty cards, and even tickets.

- 1997: Coca-Cola introduces contactless payments via mobile phones.

- 1999: PayPal launches, revolutionizing online payments.

- 2010s: Tech giants release branded wallets like Apple Pay and Google Wallet.

This shift changed how we think about money. We now tap phones instead of swiping cards.

Current Trends In Digital Payment Solutions

Mobile banking apps are now integral to our daily lives. They offer features beyond payments. Users check balances, deposit checks, and even apply for loans with a few taps.

| Year | Trend |

|---|---|

| 2021 | Biometric security features become standard. |

| 2022 | Peer-to-peer payment options expand. |

| 2023 | Cryptocurrency integration begins. |

Contactless payments also see rapid growth. They offer speed and hygiene. Restaurants, stores, and transit systems adopt this tech. Users simply wave their device near a reader, and the payment completes.

Businesses also benefit. Digital wallets provide valuable data. They track consumer habits. This data helps tailor marketing efforts.

Advantages Of Digital Wallets

The digital era brings a shift in how we manage money. Digital wallets are at the forefront of this change. They offer users a plethora of advantages. Let’s dive into some key benefits digital wallets provide.

Convenience And Speed

Digital wallets streamline transactions. They allow for quick payments with just a tap or scan of a device. No more digging for cash or cards. With digital wallets, checkout lines move faster, saving precious time.

- Pay from anywhere: Whether you’re in-store or online, payment is just a click away.

- Store multiple cards: Keep all your payment options in one place. No need for a bulky wallet.

- Send money easily: Transfer funds to friends or family instantly.

Enhanced Security Features

Digital wallets are built with security in mind. They use advanced technology to protect your money and personal information.

| Feature | Description |

|---|---|

| Encryption | Data is scrambled, making it hard for thieves to access. |

| Tokenization | A unique code is used for each transaction, not your actual card number. |

| Biometrics | Use your fingerprint or face to confirm it’s really you. |

Furthermore, if you lose your phone, you can remotely lock or wipe your digital wallet. This is not possible with a traditional wallet.

Consumer Behavior Shift

The way people spend money is changing fast. We see a big move from using notes and coins to tapping phones and cards. Let’s explore this exciting change.

From Cash To Cashless

Not long ago, wallets were full of cash. Today, they are slim with cards and smartphones. This shift is big because of two things: ease and speed. People love buying with just a tap.

- Smartphones are now wallets.

- Cards work with a quick touch.

- Watches even let you pay.

Impact Of Covid-19 On Payment Preferences

The pandemic changed how we pay. It made touch-free payments a must for safety. People did not want to touch cash. They chose digital wallets and apps more.

| Before COVID-19 | After COVID-19 |

|---|---|

| Cash was king | Digital is the new norm |

| Payments took time | Payments are now instant |

| Fear of card fraud | Trust in secure tech grows |

Mobile banking apps saw a spike in users. Everyone, from kids to grandparents, got on board. It’s a trend that’s here to stay.

Credit: www.forbes.com

Technological Innovations Driving Adoption

The shift towards digital finance is not just a trend; it’s a revolution. Key technological advancements are the main drivers behind the rapid increase in digital wallet, contactless payment, and mobile banking app adoption. These innovations offer users convenience, speed, and enhanced security, changing the way we think about money and transactions.

Blockchain And Cryptocurrency Integration

Blockchain technology is reshaping finance. It ensures secure, transparent transactions. Many digital wallets now support cryptocurrencies. Users can easily buy, store, and spend digital currencies. This integration attracts tech-savvy users and promotes digital wallet use.

- Decentralized systems protect against fraud.

- Users enjoy lower transaction fees with cryptocurrencies.

- Real-time processing speeds up transactions.

Biometric Authentication And Security

Security is a top concern in digital finance. Biometric authentication has become a game-changer. Features like fingerprint and facial recognition ensure that only you can access your funds. This layer of security gives users peace of mind.

| Feature | Benefit |

|---|---|

| Fingerprint Recognition | Quick and unique to each user. |

| Facial Recognition | Hands-free and secure. |

| Voice Authentication | Convenient for hands-busy situations. |

These innovations make digital wallets and mobile banking more attractive. They also build trust in contactless payments. As technology evolves, expect even more users to embrace these convenient financial tools.

Regulatory Landscape

The regulatory landscape is crucial in the widespread use of digital wallets, contactless payments, and mobile banking apps. Governments and regulatory bodies worldwide craft rules to ensure these technologies are safe, secure, and accessible to all. Let’s explore how regulations shape the digital payment ecosystem.

Government Initiatives Promoting Digital Payments

Government initiatives play a key role in pushing the digital economy forward. Countries are actively rolling out policies to encourage the use of digital payment methods.

- Tax incentives for merchants adopting electronic payments

- Public campaigns to raise awareness about digital finance options

- Infrastructure development to support mobile and internet connectivity

These measures aim to make digital payments a norm for citizens.

Privacy And Data Protection Concerns

With the rise of digital finance, privacy and data protection are vital. Consumers want assurance that their financial data is secure.

| Data Protection Measures | Impact |

|---|---|

| Encryption | Keeps data safe from hackers |

| Regulations like GDPR | Gives users control over their data |

| Secure authentication | Prevents unauthorized access |

Regulators ensure companies follow strict data protection laws to safeguard user information.

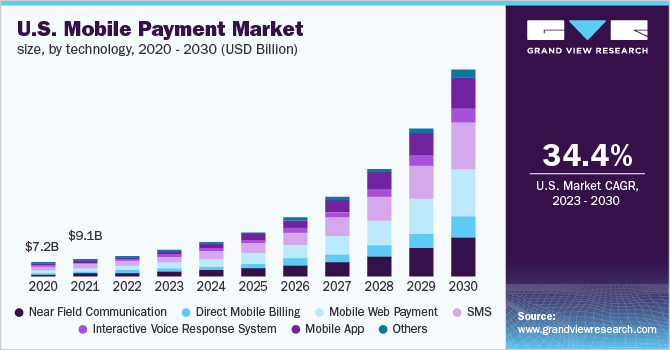

Credit: www.grandviewresearch.com

Global Market Insights

Exploring the ‘Global Market Insights’ reveals a digital revolution. Digital wallets, contactless payments, and mobile banking apps are reshaping commerce. Let’s dive into regional adoption rates and success stories from across the globe.

Regional Adoption Rates

The adoption of digital payment solutions varies by region. Asia-Pacific leads, with rapid growth in mobile wallet use. North America follows, with a preference for contactless credit cards. Europe shows steady growth, favoring secure mobile banking technologies. Latin America and Africa are catching up, driven by mobile-first populations.

| Region | Digital Wallets | Contactless Payments | Mobile Banking |

|---|---|---|---|

| Asia-Pacific | High | Medium | High |

| North America | Medium | High | Medium |

| Europe | Medium | Medium | High |

| Latin America | Low | Low | Medium |

| Africa | Low | Low | Medium |

Success Stories From Around The World

In China, Alipay and WeChat Pay dominate the market. India’s Paytm showcases fintech innovation, influencing millions. In Sweden, Swish propels the country towards a cashless society. Kenya’s M-Pesa revolutionizes mobile banking, empowering users. These stories highlight the global shift to digital finance.

- China: Alipay, WeChat Pay

- India: Paytm

- Sweden: Swish

- Kenya: M-Pesa

Challenges And Barriers

As we embrace the convenience of digital wallets, contactless payments, and mobile banking apps, we face certain challenges and barriers. These obstacles can slow down the widespread adoption of these technologies. Let’s delve into some of these hurdles.

Digital Divide And Accessibility Issues

The digital divide separates users who have access to modern technology from those who do not. This gap presents a major challenge. Not all individuals have the necessary tools for digital finance.

- Limited internet access hinders digital wallet use.

- Not everyone owns a smartphone for mobile banking.

- Older populations might struggle with new tech.

Accessibility issues also pose a barrier. These concerns include:

- Apps not designed for users with disabilities.

- Complex user interfaces that confuse new users.

- Language barriers that exclude non-native speakers.

Resistance To Change And Trust Deficit

Many people hesitate to try new technologies. They prefer traditional banking methods. Resistance to change is a significant barrier:

- People fear losing money through new payment methods.

- Old habits die hard, especially in finance.

Trust deficit affects the adoption rate too. Concerns include:

| Trust Issues | Impact |

|---|---|

| Data breaches | Users worry about personal info security. |

| Fraud cases | Scams make users skeptical of digital payments. |

| Lack of regulation | Unclear policies can deter users. |

Credit: www.csis.org

Looking Ahead

The landscape of financial transactions is changing rapidly. Digital wallets, contactless payments, and mobile banking apps are not just trends. They are becoming the backbone of daily commerce. As we peer into the future, these technologies are set to redefine our spending habits even further.

Predictions For The Next Decade

- Greater convenience with seamless transactions will be normal.

- Enhanced security features will make digital payments safer.

- Wider adoption as more people shift from cash to digital options.

- Integration with IoT devices will lead to more automated payments.

- Global accessibility will improve, connecting more users worldwide.

As the next decade unfolds, the way we pay for goods and services will evolve dramatically. Digital solutions will dominate, offering unmatched speed and efficiency.

Role Of Digital Wallets In The Future Economy

Digital wallets are set to play a pivotal role in the future economy. They will act as the primary tool for financial transactions. Here’s how:

| Aspect | Impact |

|---|---|

| User Experience | Instant payments will improve customer satisfaction. |

| Financial Inclusion | More people will gain access to banking services. |

| Economic Growth | Digital wallets will drive commerce, boosting economies. |

| Sustainability | Reduction in paper-based currency aids the environment. |

The integration of digital wallets will be essential for a thriving, modern economy. They will support a range of financial activities, from small-scale purchases to large business transactions.

Frequently Asked Questions

What Is A Major Reason For The Increasing Acceptance Of Contactless Payments?

A major reason for the rise in contactless payments is the convenience and speed they offer during transactions.

How Does It Improve The Adoption Of E-wallet As A Payment Method?

E-wallet adoption grows as it offers quick, secure transactions and enhances user convenience. It simplifies online purchases and streamlines in-store checkouts.

What Is The Adoption Of Digital Wallets?

The adoption of digital wallets refers to the increasing use of electronic systems to store payment information and make transactions via smartphones or online platforms.

What Are The Benefits Of Adopting Digital Payments?

Digital payments offer enhanced convenience, faster transactions, and lower physical cash handling. They enable easy tracking of expenses and often provide rewards and cash-back benefits. Secure encryption technology helps protect against fraud.

Conclusion

Embracing digital wallets, contactless payments, and mobile banking is no longer a trend—it’s a necessity. With convenience at their core, these technologies are reshaping how we handle money. As consumers and businesses alike seek efficiency and security, the shift toward a cashless society seems inevitable.

Don’t get left behind; the digital financial revolution is here to stay. Make the switch to smarter spending and banking today.