Mobile money and digital remittances are revolutionizing financial transactions globally. They offer unparalleled convenience and efficiency for users.

The advent of mobile money has transformed the way individuals manage their finances, especially in regions with limited access to traditional banking services. Digital remittances, on the other hand, have simplified the process of sending money across borders, providing a lifeline for economies that rely heavily on funds sent home by expatriates.

Together, these digital solutions are not only empowering consumers but also fostering economic growth and financial inclusion. They reduce transaction costs, increase security, and provide real-time money transfer services. This financial technology evolution is creating new opportunities for businesses, enhancing the resilience of financial systems, and paving the way for innovative economic solutions in both developed and developing markets. As smartphone penetration continues to surge, the potential for mobile money and digital remittances is poised for even greater expansion.

The Rise Of Mobile Money

Imagine buying groceries, paying bills, or sending money to friends—all from your phone. This isn’t a future scenario; it’s today’s reality with mobile money. In many parts of the world, mobile wallets are becoming more popular than traditional bank accounts. They offer an easy, fast, and secure way to manage finances. Let’s explore what’s driving this change and its effects on the banking industry.

Factors Driving Mobile Money Adoption

- Convenience: Users enjoy 24/7 access to their funds.

- Accessibility: No need for a physical bank branch.

- Inclusivity: Serves those previously unbanked.

- Lower Costs: Typically cheaper than traditional banking.

- Speed: Instant transfers make life easier.

- Security: Advanced encryption protects users’ money.

Impact On Traditional Banking

Traditional banks face a new challenge with the rise of mobile money. Customers now expect digital solutions. Banks must innovate or risk losing clients. They are adapting by offering mobile banking apps and improving online services. The financial landscape is changing fast, and mobile money is at the forefront of this transformation.

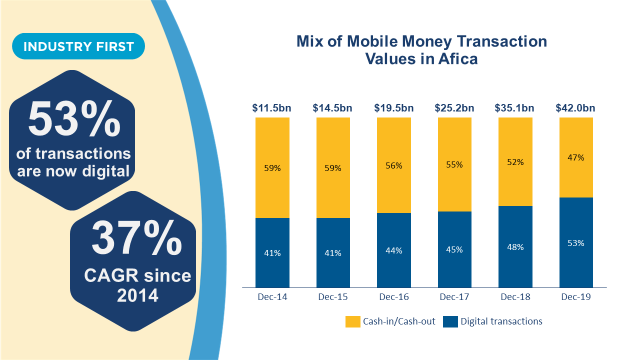

Credit: www.gsma.com

Mobile Money Ecosystem

The Mobile Money Ecosystem is a dynamic network. It brings together technology, financial services, and consumers. It allows money transfers via mobile devices. This ecosystem is transforming how we think about money and payments.

Key Players And Stakeholders

In the mobile money landscape, various key players drive growth. Here are some:

- Mobile Network Operators (MNOs): They provide the needed infrastructure.

- Financial Institutions: Banks and microfinance entities bring trust and regulatory compliance.

- Payment Service Providers: They offer platforms for transactions.

- Regulators: These bodies ensure fair practices and security.

- Merchants and Consumers: They use services, pushing demand.

Infrastructure And Technology

The backbone of mobile money services is cutting-edge technology. Let’s explore:

| Component | Description |

|---|---|

| Mobile Devices | Phones and tablets that enable access to services. |

| Networks | Cellular and internet infrastructures for connectivity. |

| Payment Platforms | Software systems that process transactions securely. |

| Security Protocols | Measures to protect data and money from fraud. |

With robust infrastructure, the ecosystem supports seamless money flows. It brings convenience and efficiency to users worldwide.

Global Remittance Flows

Global Remittance Flows are a lifeline for millions around the world. Money sent home by migrants boosts the economy of their home countries and supports families. In recent years, this flow of funds has seen a significant shift. Digital platforms are taking center stage.

Current Trends In International Money Transfers

Today, the traditional methods of sending money cross-border are evolving. Banks and money transfer operators face new competitors. Digital remittance services are on the rise. They offer faster, cheaper, and more convenient options. Users can send money with just a few taps on their smartphones.

- Mobile apps lead the charge in modern remittance services.

- Blockchain technology is emerging as a key player.

- Real-time transfers become the expected norm.

Role Of Mobile Technology In Remittances

Mobile technology transforms how people send and receive money. Smartphones are widely available. They are also affordable. This accessibility has created a new era for remittances. The role of mobile technology is pivotal.

- Mobile wallets enable users to store and transfer funds digitally.

- Text messages can confirm transactions instantly.

- Biometric security keeps mobile transactions safe.

| Feature | Benefit |

|---|---|

| 24/7 availability | No need to wait for business hours |

| Low fees | More money reaches the recipient |

| Global reach | Money can be sent anywhere |

With these advancements, mobile money and digital remittances are set to soar. They will shape the future of global remittance flows.

Economic Impacts Of Mobile Money

The advent of mobile money revolutionizes economic landscapes globally. Its impact extends beyond convenience, shaping economies at their core. Mobile money platforms ignite widespread financial accessibility, fueling economic growth and stability.

Effects On Financial Inclusion

Mobile money services significantly boost financial inclusion. They bring banking to the unbanked. Users can save, transfer, and receive funds using just their mobile phones. This fosters economic empowerment for millions.

- Account Ownership: Increases in regions with limited bank infrastructure.

- Small Business Growth: Entrepreneurs gain access to credit and payment options.

- Women’s Empowerment: Female users gain financial autonomy and security.

Contribution To Gdp Growth

Mobile money services play a crucial role in GDP growth. They stimulate economic activity by enabling seamless transactions. Businesses benefit from the efficiency and reach of mobile payments.

| Aspect | Impact |

|---|---|

| Transaction Volume | Higher transaction volumes contribute to economic activity. |

| Employment | Mobile money services create jobs in tech and customer service. |

| Market Expansion | Businesses reach new markets through mobile platforms. |

Studies show a direct correlation between mobile money usage and GDP growth. Countries with robust mobile money ecosystems often see their economies thrive.

Case Studies Of Success

The digital revolution has rewritten the rules of money transfer. Mobile money and digital remittances are transforming economies, especially in regions where banking services are scarce. Through a series of case studies, we can observe the tangible success of these technologies. They are not just concepts, but real-world solutions with profound impacts.

Mobile Money In East Africa

East Africa leads the mobile money revolution. M-Pesa, the mobile phone-based money transfer service, started in Kenya. It has become a global model for mobile banking. Here are key highlights:

- Over 40 million users rely on M-Pesa across Kenya.

- Users can deposit, withdraw, and transfer money easily with a mobile device.

- Small businesses have grown, thanks to mobile transactions.

- It has reduced poverty, especially among women and in rural areas.

Other countries in the region, like Tanzania and Uganda, also report success with similar services.

Asia’s Growing Mobile Remittance Market

Asia’s mobile remittance market is booming. Countries like the Philippines and India see a surge in mobile-based financial services. The success stories include:

| Country | Service | Impact |

|---|---|---|

| Philippines | GCash and PayMaya | Millions use these apps for daily transactions. |

| India | Paytm | Business growth and financial inclusion have improved. |

These services help families send and receive money fast and safely. They boost local economies and help people without bank accounts.

Challenges And Risks

The rise of mobile money and digital remittances is a game-changer. It is transforming how we send and receive money across borders. Yet, this innovation is not without its challenges and risks. Let’s explore the hurdles and concerns that need addressing.

Regulatory Hurdles

Global finance rules are complex. Each country has its own set of regulations. Mobile money providers must navigate these. They need to comply with international standards and local laws. This can be a tough task.

Providers must work with different governments. They need to ensure their services are legal and safe. This is vital for customer trust and the system’s integrity.

Security And Fraud Concerns

Digital platforms face security threats. Hackers try to exploit any weakness. Mobile money services must invest in strong security measures to protect users’ funds and personal information.

- User education is essential. Customers need to know how to keep their accounts safe.

- Two-factor authentication is a key security feature.

- Regular software updates help guard against new threats.

Fraudsters are always finding new ways to cheat the system. Providers must stay ahead with advanced fraud detection tools. They need to monitor transactions and flag any suspicious activity.

Despite these challenges, mobile money and digital remittances hold a lot of promise. They offer a fast, affordable, and convenient way to manage finances. With the right safeguards, they can thrive and transform financial inclusion globally.

Innovations In Mobile Money Services

Innovations in Mobile Money Services are transforming how people manage their finances. These services offer convenient, fast, and secure transactions. They are changing the game for consumers and businesses alike. Let’s explore the cutting-edge changes shaping the future of mobile money.

Emerging Technologies

New technologies are at the forefront of mobile money evolution. They make transactions safer and faster. Key innovations include:

- Blockchain: This tech adds extra security layers. It makes payments almost impossible to hack.

- Biometrics: Fingerprint and facial recognition ensure that only you can access your funds.

- 5G connectivity: Super-fast internet speeds up transactions. It means no more waiting for payments to process.

Enhancing User Experience

User experience is crucial in mobile money services. Companies are making their apps easier and more enjoyable to use. They are doing this by:

- Creating intuitive interfaces that guide users smoothly through each step.

- Adding personalized features, like spending trackers and savings goals.

- Ensuring 24/7 customer support is available to help users at any time.

These improvements help users feel confident and in control of their money.

Credit: www.paymentsjournal.com

Future Outlook

The digital revolution has reshaped how we handle money. Mobile money and digital remittances are at the forefront of this change. They offer speed, security, and convenience. Let’s explore what the future might hold for these financial services.

Predictions For The Mobile Money Market

Experts predict significant growth in the mobile money sector. This growth is driven by innovation and technology adoption. The rise of smartphones has made mobile money services accessible to billions. Emerging markets lead this expansion. They provide financial services to those without bank accounts.

- Global mobile money transactions could reach $12 trillion by 2025.

- Asia and Africa will likely see the highest growth rates.

- Blockchain technology could make transactions more secure and transparent.

Strategies For Sustained Growth

To keep growing, mobile money providers need to focus on certain strategies. These strategies will ensure they stay relevant and useful.

| Strategy | Impact |

|---|---|

| User Experience | Improving app design and ease of use to keep users engaged. |

| Security Measures | Using advanced security to protect users’ money and data. |

| Financial Inclusion | Reaching unbanked populations to grow the user base. |

| Partnerships | Collaborating with banks and other institutions to expand services. |

| Innovation | Introducing new features to meet users’ evolving needs. |

Regulatory support is also crucial. Governments and financial authorities need to create policies that foster growth. They must also protect consumers. This balance will help the mobile money market thrive.

Credit: www.csis.org

Frequently Asked Questions

What Are The Benefits Of Digital Remittance?

Digital remittance offers quick transfers, reduced fees, secure transactions, convenient access, and supports financial inclusion across borders.

What Is The Importance And Potential Use Of Remittances In The Receiving Country?

Remittances bolster the economy of the receiving country by increasing household incomes, enhancing savings, and funding small businesses. They also help alleviate poverty and can contribute to better health and education outcomes.

What Is A Digital Remittance?

A digital remittance is an electronic transfer of funds from an individual in one country to a recipient in another, typically using online services or mobile applications.

What Percent Of Remittances Are Digital?

As of 2021, around 74% of global remittances are transferred through digital channels. This trend reflects the growing reliance on technology for financial transactions.

Conclusion

Embracing mobile money and digital remittances marks a leap forward in financial inclusivity. These platforms offer secure, swift transactions that revolutionize our approach to money management. By tapping into their potential, we can bridge gaps and connect global economies like never before.

Let’s unlock the future of finance together.