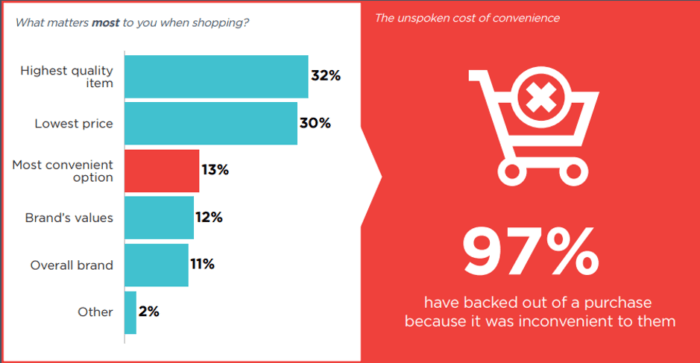

Digital transactions offer unmatched convenience and speed, fueling their demand among consumers. Quick, seamless payments are now a priority for shoppers globally.

Today’s consumers prioritize efficiency and ease of use in all aspects of their lives, including financial transactions. The rise of digital payment platforms has revolutionized the way we handle money, offering instant transfers and purchases at the click of a button.

The digital economy thrives on the ability to make rapid transactions without the traditional boundaries of time and geography. This has led to a surge in consumer demand for digital payment options, as people seek ways to save time and simplify their financial activities. Security enhancements and user-friendly interfaces further propel the attractiveness of digital transactions, making them a staple in everyday commerce. As businesses adapt to this digital shift, they ensure a competitive edge by meeting consumer expectations for swift and effortless payment solutions.

Credit: www.nmi.com

The Rise Of Digital Transactions

In recent years, digital transactions have surged, transforming how consumers manage finances. This shift reflects a growing preference for convenience and speed in everyday purchases and bill payments. Let’s explore the factors fueling this change.

Shift From Physical To Digital

The move from cash and checks to digital payment methods marks a significant change in consumer behavior. Factors include:

- 24/7 access to banking services

- Instant money transfers

- Secure online payment options

- Integration with mobile apps

These features make digital transactions attractive to users. They enjoy the ease of clicking a button to complete a payment.

E-commerce Boom

Online shopping has become a staple for consumers worldwide. The e-commerce sector’s explosive growth is evident in:

| Year | Global E-commerce Sales |

|---|---|

| 2020 | $4.28 trillion |

| 2021 | $4.9 trillion |

With more people buying online, digital payments are essential. They enable seamless checkout processes and secure transactions. This convenience keeps customers returning.

Consumer Expectations In The Digital Age

In the digital age, customer expectations have skyrocketed. The immediacy of internet access has set new standards for service speed and availability. Consumers now demand that their transactions not only be secure but also instantaneous and accessible at any time. Let’s explore how these expectations shape the world of digital transactions.

Instant Gratification

Today’s consumers seek quick and efficient services. They value their time and prefer transactions that happen in seconds. This shift has led to a surge in digital payment solutions that offer immediate results.

- Fast checkouts

- Immediate payment confirmations

- Real-time account updates

24/7 Availability

Round-the-clock service has become a non-negotiable aspect of digital transactions. Users expect to access services and conduct business anytime, anywhere. This demand has pushed companies to ensure:

| Service | Availability |

|---|---|

| Online banking | 24/7 |

| Customer support | Always on |

| Transaction processing | Non-stop |

With these expectations set, businesses must adapt to stay competitive and satisfy the modern consumer’s needs for speed and continuous availability.

Technological Advancements Driving Speed

Digital transactions have become a staple in our fast-paced world. Consumers expect quick and seamless payment experiences. This demand has led to incredible technological breakthroughs in payment processing. Let’s explore the innovations that are changing the game.

Innovation In Payment Gateways

Payment gateways are vital for secure and swift transactions. New technologies ensure transactions are not just fast, but also safe. Here’s how:

- Encryption methods protect data from fraud.

- Tokenization replaces sensitive details with unique symbols.

- Gateways now process payments in seconds.

Businesses worldwide adopt these gateways to give customers the speed they crave.

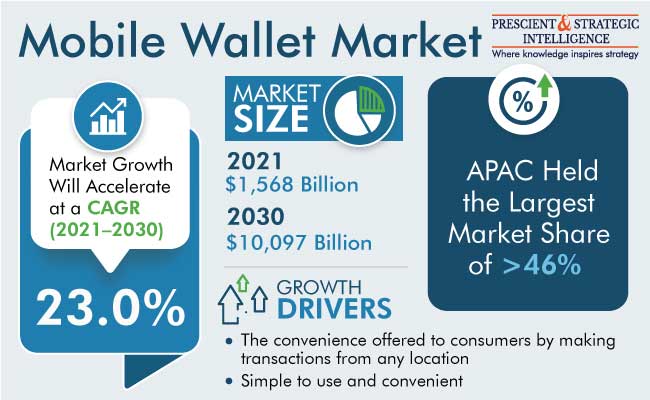

Mobile Wallet Evolution

Mobile wallets are more than a trend; they’re a lifestyle change. Carrying cash or cards is becoming obsolete. Mobile wallets offer:

| Feature | Benefit |

|---|---|

| One-tap payments | Effortless checkouts |

| Real-time tracking | Instant transaction updates |

| Security protocols | Reduced risk of theft |

Convenience and efficiency are the heart of mobile wallet design. They’re reshaping the way we think about money.

Security Concerns And Solutions

As digital transactions become faster and more convenient, security remains a top priority for consumers. Protecting sensitive information is crucial to maintaining trust and ensuring a safe online experience. Let’s explore how advanced security measures address these concerns and provide robust solutions.

Encryption And Data Protection

Encryption is the shield guarding our digital information. When data is encrypted, it turns into a code that only authorized users can decipher. This process keeps our personal details safe from prying eyes during a transaction.

Leading financial institutions employ strong encryption protocols such as TLS (Transport Layer Security) and SSL (Secure Socket Layers) to ensure that all data remains secure. Here’s how they work:

- TLS creates a secure channel between two devices, making it difficult for hackers to access.

- SSL uses certificates to authenticate a website’s identity, adding another layer of trust.

These technologies are vital in the fight against data breaches and cyber threats.

Biometric Authentication

Biometric authentication takes security to a personal level. It uses our unique features, like fingerprints and facial recognition, to confirm identity. This method is harder to fake, making digital transactions much safer.

Here are some common biometric features used today:

- Fingerprint scanners on smartphones

- Facial recognition systems on banking apps

- Voice recognition for customer service verification

With biometric authentication, users enjoy a seamless yet secure transaction process.

Impact On Traditional Banking

The rise of digital transactions has reshaped consumer expectations. Customers seek quick and seamless banking experiences. Traditional banks face the challenge of evolving with these demands. Let’s explore how banking services have transformed.

Branch Vs. Online Services

Physical bank branches once stood as the pillars of financial transactions. Customers would visit to deposit checks, withdraw cash, or discuss loans. The scene is changing. Digital platforms offer the same services without the wait. Users transfer money, pay bills, and apply for credit in minutes. This shift has caused banks to rethink their branch networks.

- ATMs and self-service kiosks are more common.

- Branches now focus on complex services and personal advice.

Online banking features include:

| Service | Online Feature |

|---|---|

| Account Management | 24/7 access, real-time updates |

| Money Transfer | Instant, multiple platforms |

| Bill Payments | Scheduled, automatic |

| Customer Support | Live chat, email, phone |

Banks Adapting To Change

Banks are embracing technology to stay relevant. They develop mobile apps and online banking portals. User-friendly interfaces and secure transactions are top priorities.

- Digital-only accounts with attractive perks are on the rise.

- Traditional banks partner with fintech companies for advanced solutions.

- Investment in cybersecurity ensures customer trust in digital services.

Staff training focuses on tech skills and customer support for digital services. Banks are reshaping their roles in the financial ecosystem. They prioritize flexibility and customer-centric approaches to meet the new wave of banking.

Credit: www.infotech.com

Global Trends In Digital Payments

The landscape of financial transactions is transforming rapidly. Digital payments are at the forefront of this change. Consumers and businesses alike seek speed and convenience. This shift is evident across the globe. Let’s explore how this trend is unfolding worldwide.

Emerging Markets Catching Up

Emerging economies are now hotspots for digital payment adoption. The rise in mobile connectivity fuels this trend. Affordable smartphones bring banking to people’s fingertips. In regions like Africa and Asia, mobile wallets are becoming the norm. This leapfrogs traditional banking methods. People enjoy easy access to financial services.

- Mobile wallet usage soars in Asia and Africa

- Digital banking leapfrogs traditional methods

- Financial inclusion improves in rural areas

Cross-border Transaction Growth

Globalization drives demand for cross-border payments. Businesses and individuals engage in international transactions more than ever. E-commerce platforms enable seamless global shopping experiences. Consumers expect fast and secure cross-border payments. Digital payment platforms cater to this need. They simplify currency exchange and reduce transaction times.

| Year | Cross-border Transactions (in billion USD) |

|---|---|

| 2021 | 156 |

| 2022 | 172 |

| 2023 (Projected) | 200+ |

Technological advances make cross-border payments faster and cheaper. Innovations like blockchain and real-time processing gain traction. These technologies ensure secure and instant transactions across borders.

- E-commerce drives international shopping

- Real-time processing gains popularity

- Blockchain enhances security and speed

Future Of Transactions: Going Cashless?

The march towards a cashless society is underway as digital transactions redefine consumer experiences. The allure of instant payments and the diminishing need for physical wallets signal a shift in how people handle money. This blog delves into the cashless frontier, exploring society’s readiness and the potential economic impact of abandoning paper currency.

Society’s Readiness

Embracing the cashless revolution depends on several factors. Key among them is the public’s comfort with technology. People are increasingly relying on smartphones and contactless cards for everyday purchases. This shift reflects a growing confidence in digital security and ease of use.

- Availability of Technology: Most consumers now own devices capable of digital payments.

- Internet Access: Widespread connectivity allows for seamless transactions.

- Educational Initiatives: Programs aimed at teaching digital literacy are expanding.

Moreover, businesses are upgrading systems to accept various forms of e-payments. This includes using QR codes, mobile apps, and NFC technology. The transition to cashless operations is becoming less of an option and more of a necessity for retailers.

Potential Economic Impact

The shift to a cashless economy holds promise for efficient commerce and financial inclusion. Digital transactions can streamline accounting and reduce the costs associated with handling cash. They can also provide valuable data insights for businesses to tailor customer experiences. Let’s look at the potential economic benefits:

| Benefit | Description |

|---|---|

| Reduced Costs | Less spending on printing, securing, and transporting cash. |

| Increased Transparency | Digital trails reduce tax evasion and illegal activities. |

| Financial Inclusion | Access to digital wallets for those without traditional bank accounts. |

On the flip side, concerns about privacy and data security remain. Not all consumers are convinced about sharing financial details online. The digital divide also poses a challenge, as not everyone has equal access to the necessary technology or connectivity. Governments and financial institutions are working to address these hurdles, ensuring that the benefits of going cashless are shared by all.

Credit: www.smartinsights.com

Challenges And Opportunities Ahead

As digital transactions reshape the consumer landscape, they bring both hurdles and new chances. Understanding these will help businesses thrive in the evolving digital economy.

Regulatory Hurdles

Digital transactions must navigate a complex web of laws. Security and privacy concerns top the list. Governments worldwide are crafting rules to protect users. This means strict compliance for businesses. They must stay ahead of changing regulations to avoid penalties and maintain customer trust.

Innovative Startups Entering The Market

New players bring fresh ideas to digital finance. They offer quick, user-friendly services that appeal to tech-savvy consumers. These startups challenge traditional models. They push the envelope on what’s possible, creating a dynamic, competitive landscape. Established businesses must adapt or partner with these innovators to stay relevant.

Frequently Asked Questions

How Do Speed And Security Influence Consumers Payment Behavior?

Speedy transactions enhance customer satisfaction, encouraging repeat business. Robust security builds trust, influencing consumers to transact with confidence.

What Is One Way That Digital Payments Are Convenient For Buyers?

Digital payments offer buyers the convenience of quick, seamless transactions without the need for physical cash.

Why Is Digital Payment Convenient?

Digital payments offer swift transactions, enhanced security, and are accessible anytime, anywhere, streamlining purchases and bill settlements.

What Are The Benefits Of Digital Payments For Consumers?

Digital payments offer consumers convenience, faster transactions, and enhanced security. They enable easy tracking of expenses and often reduce transaction costs.

Conclusion

The digital era has reshaped how we manage finances, with speed and convenience at its heart. As consumer preferences shift, embracing online transactions becomes essential. Businesses must adapt to stay ahead, ensuring secure, swift service. The future is digital, and with consumer demand as our compass, we navigate towards innovation and efficiency.

Stay updated, stay ahead.