Leveraging digital transactions can significantly enhance financial inclusion for underbanked and unbanked populations. Digital platforms offer convenient, low-cost banking solutions to those traditionally excluded from the financial system.

In today’s global economy, access to financial services is crucial for individual growth and empowerment. Yet, millions remain on the periphery, lacking basic banking facilities. Digital transactions present a unique opportunity to bridge this gap, providing the underbanked and unbanked with tools for savings, payments, and credit.

By embracing mobile technology and online banking, these groups can participate in the financial mainstream without the need for traditional banking infrastructure. This not only fosters economic inclusion but also stimulates local economies. As the world continues to digitize, financial service providers are increasingly recognizing the potential of digital solutions to reach untapped markets, thereby contributing to a more inclusive economic landscape.

Credit: issuu.com

The Rise Of Digital Transactions

The digital landscape is transforming rapidly, and the way people transact is no exception. The shift from traditional banking to digital platforms marks a significant milestone in financial accessibility. This transition opens up a world of possibilities for those who previously had limited access to financial services.

From Cash To Cashless: A Global Trend

The movement from physical currency to digital payments is becoming widespread. Countries across the globe are embracing cashless solutions. This shift is not just convenient but also promotes financial inclusion. Digital transactions allow easy access to banking services, especially for underbanked and unbanked populations.

- Increased mobile phone usage has led to more mobile banking.

- Online shopping growth fuels the need for digital payments.

- Government policies support cashless economies to reduce corruption and increase transparency.

Key Players Driving The Digital Payment Ecosystem

Digital payment systems are powered by a diverse group of players. Each contributes to a robust and accessible financial ecosystem.

| Player Type | Role |

|---|---|

| Fintech Companies | They innovate and provide user-friendly platforms. |

| Banks | Banks now offer digital services to stay competitive. |

| Telecom Providers | They enable mobile money services, even in remote areas. |

| Payment Processors | These players handle transaction processing. |

| Government Entities | They set regulations and promote digital payments. |

These key players work together to create a seamless digital transaction experience. Their collaboration ensures that even those without traditional bank accounts can participate in the digital economy.

Barriers To Inclusive Finance

Access to financial services is a key step towards economic empowerment. Yet, for many, this remains out of reach. The unbanked and underbanked populations face barriers that prevent them from fully participating in the financial ecosystem. Identifying and understanding these barriers is the first step towards creating a more inclusive financial environment for all.

Understanding The Unbanked And Underbanked

The unbanked are individuals without any bank account. They rely on cash or alternative services for financial transactions. The underbanked have bank accounts but still use alternative financial services. These might include payday loans, money orders, and check-cashing services. Factors contributing to this status often include low income, lack of trust in banks, and high fees.

Technological And Infrastructural Challenges

Technology can bridge financial gaps. But many unbanked and underbanked individuals face technological barriers. Poor internet connectivity and lack of access to smartphones or computers can hinder their participation. Furthermore, the infrastructure to support digital transactions, like ATMs and bank branches, may be sparse or nonexistent in certain areas. These challenges make it hard for these populations to engage with digital financial services.

- Lack of internet access limits online banking options.

- Limited digital literacy can make technology seem daunting.

- Inadequate financial infrastructure in some regions restricts access to services.

Addressing these barriers is crucial for financial inclusion. It ensures everyone has the opportunity to manage their finances effectively and securely.

Benefits Of Digital Transactions For Inclusivity

The shift toward digital transactions opens a world of possibilities for inclusivity. With technology, financial services reach those once overlooked. Underbanked and unbanked populations now have a path to join the economic mainstream. Let’s explore how digital transactions can level the playing field.

Lower Transaction Costs And Increased Accessibility

Digital platforms reduce the need for physical banking infrastructure. This slashes transaction costs significantly. Lower costs mean savings for users, particularly those with limited funds. With internet access, anyone can tap into banking services, anytime, anywhere. This breaks down barriers to financial inclusion.

- ATM fees eliminated: No need for cash withdrawals from costly machines.

- No branch visits: Save on transportation to and from banks.

- Minimal service charges: Online transactions often carry lower fees.

Real-time Payments And Financial Empowerment

Instant payments transform financial management. Users gain control over their money with immediate transactions. This empowerment is crucial for those on tight budgets. Real-time payments help avoid overdraft fees and allow quick response to financial emergencies.

| Feature | Benefit |

|---|---|

| Instant Transfers | Manage funds efficiently. |

| Up-to-the-minute Balance | Track spending effectively. |

| 24/7 Access | Bank on your schedule. |

Mobile Money As A Gateway To Inclusion

Imagine a world where everyone has access to financial services. Mobile money is making this a reality. It helps people who do not have bank accounts. They can now pay bills, save money, and even get loans. This is very important for people in rural areas or in poor countries.

Success Stories From Around The World

Many countries show how mobile money changes lives. Let’s look at some examples:

- Kenya: M-Pesa is a big success. Millions use it to send and receive money.

- India: Paytm helps people shop and pay bills using their phones.

- Brazil: People use PicPay to transfer money easily.

These stories show that mobile money works. It can help many people join the financial system.

The Role Of Telecoms In Expanding Financial Access

Telecom companies are very important for mobile money. They have the technology and networks. They can reach many people fast.

| Company | Contribution |

|---|---|

| MTN | They offer mobile banking in Africa. It’s called MoMo. |

| Vodafone | They started M-Pesa. It’s a big mobile money service. |

| Orange | They have Orange Money. It works in many countries. |

These companies help more people use mobile money. This means more people can handle their money safely.

Fintech Innovations Bridging The Gap

Financial technology, or fintech, is revolutionizing how people access financial services. Innovative solutions are now reaching those who were previously left out of the financial system. This includes underbanked and unbanked populations around the world. Digital transactions are key to this inclusion.

Startups Shaping The Future Of Finance

Dynamic fintech startups are at the forefront of change. They design services for easy use on mobile devices. This makes banking possible for people without traditional bank accounts. Users can now transfer money, pay bills, and save funds securely.

- Mobile wallets for convenient payments

- Peer-to-peer lending platforms for easy credit

- Micro-insurance products for affordable coverage

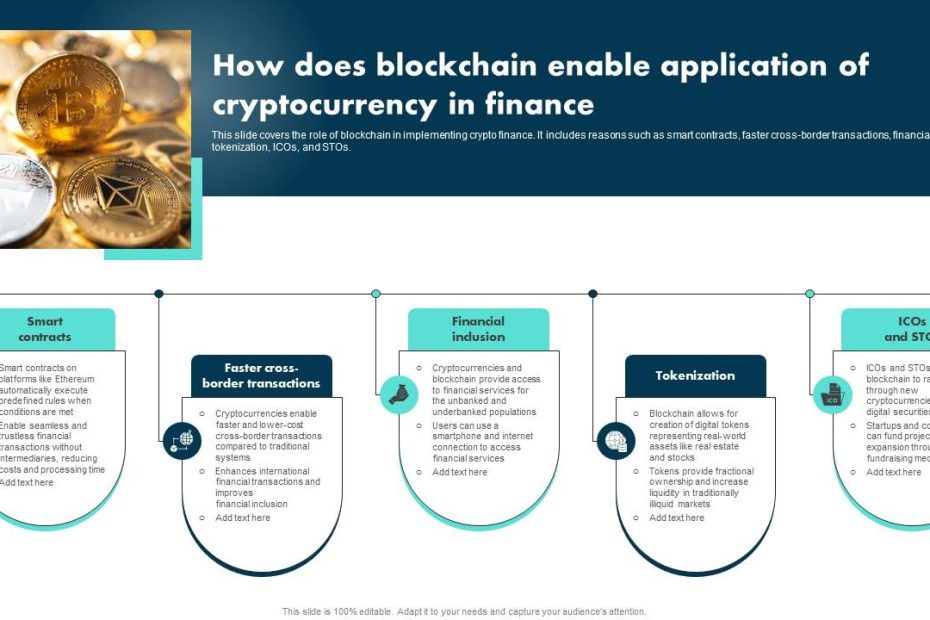

The Impact Of Blockchain And Cryptocurrencies

Blockchain technology and cryptocurrencies offer another layer of access. They allow secure and transparent transactions. This is crucial for trust in financial dealings. Cryptocurrencies also reduce the need for traditional banking infrastructure.

| Benefit | Explanation |

|---|---|

| Lower Costs | Users save on transfer fees and other charges. |

| Global Reach | People can send and receive money across borders easily. |

| Financial Inclusion | Everyone gets a chance to join the global economy. |

Cryptocurrencies are not just for the tech-savvy. They are becoming user-friendly. This helps more people use digital money in their daily lives.

Credit: www.linkedin.com

Policy Frameworks And Regulation

In today’s digital age, policy frameworks and regulation play a pivotal role in shaping how financial services reach the underbanked and unbanked populations. Effective policies can bridge the gap between these individuals and the traditional banking system, leveraging digital transactions as a gateway to financial inclusion.

Government Initiatives For Financial Inclusion

Governments worldwide are launching initiatives to boost financial inclusion. These programs aim to ensure everyone has access to affordable financial services. By introducing regulations that encourage mobile banking and digital payments, authorities are making it easier for people to join the financial ecosystem.

- Mobile money accounts offer a direct link to banking services.

- Digital ID systems help in verifying identities quickly.

- Subsidies and grants are distributed efficiently through digital platforms.

Balancing Innovation With Consumer Protection

While innovation drives financial inclusion, consumer protection remains crucial. Regulators work to balance these two by setting up frameworks that nurture innovation while safeguarding consumers. They focus on:

- Protecting consumer data to maintain trust.

- Ensuring fair practices by service providers.

- Monitoring transaction security to prevent fraud.

Challenges In Adopting Digital Transactions

The journey towards financial inclusion through digital transactions is not without its hurdles. Embracing technology to serve underbanked and unbanked communities presents unique challenges. These obstacles must be addressed to ensure a secure, accessible, and trustworthy digital finance ecosystem.

Cybersecurity Threats And Privacy Concerns

With the rise of digital transactions, data breaches and fraud are major concerns. Personal information is at risk when transmitted online. Banks and service providers invest heavily in securing their systems, yet threats evolve continuously. Users fear their sensitive data may fall into the wrong hands, leading to hesitation in adopting digital financial services.

Digital Literacy And User Trust

For many, the digital world is complex and intimidating. Understanding how to navigate digital platforms is a barrier. Trust is also crucial. Without it, people stick to traditional banking or cash transactions. Building confidence in digital systems is key to bringing more users into the fold of financial technology.

- Education programs are vital for improving digital literacy.

- Clear instructions and user-friendly interfaces help build user trust.

- Regular updates and transparent communication from service providers can strengthen security perceptions.

The Future Of Inclusive Finance

The Future of Inclusive Finance promises a world where everyone has access to financial services. Technological advances are paving the way for this reality. Digital transactions are at the heart of this shift. They offer a bridge over the traditional banking gap for underbanked and unbanked communities.

Predictions For Digital Transactions

Experts foresee a surge in digital transactions. These transactions will be more secure, fast, and user-friendly. Here’s what to expect:

- Mobile payment adoption will soar among all age groups.

- Digital currencies will gain more trust and usage.

- Peer-to-peer lending platforms will become more popular.

Integrating Ai And Machine Learning For Personalized Services

Artificial Intelligence (AI) and Machine Learning (ML) will tailor financial services. They will help users manage their money better. Here are some anticipated developments:

- AI-driven chatbots will provide 24/7 customer support.

- ML algorithms will offer personalized financial advice.

- Smart apps will help users track spending and save money.

Credit: issuu.com

Frequently Asked Questions

What Are The Alternatives To Using A Bank That Unbanked Underbanked People Utilize?

Unbanked and underbanked individuals often use check cashing services, money orders, prepaid debit cards, mobile payments, and community-based lending circles.

What Does It Mean To Be Unbanked And Underbanked?

Being unbanked means having no bank account, while underbanked individuals have a bank account but also rely on alternative financial services.

How Financial Technology Can Improve Costs And Access For The Unbanked Underbanked Population?

Financial technology reduces costs through digital transactions and eliminates traditional banking fees. It offers easy access to financial services via mobile platforms, reaching unbanked and underbanked individuals effectively.

How Might The Shift Towards Digital Banking Impact People Who Are Unbanked?

The shift to digital banking may exclude unbanked individuals, making access to financial services and technology more challenging. It can also widen the digital divide, as unbanked populations might lack the necessary resources or skills to engage with digital financial platforms.

Conclusion

Embracing digital transactions opens doors for those often left out of the financial mainstream. Smart technology integration can empower the underbanked and unbanked, fostering financial inclusion and economic growth. By prioritizing accessibility and education, we ensure that everyone has a chance to join the digital economy, benefiting individuals and communities alike.

Let’s commit to bridging these gaps for a more inclusive future.