Open banking and API-driven innovation are revolutionizing the financial sector. They enable the creation of novel products and services tailored to consumer needs.

The financial landscape is undergoing a transformative shift, thanks to open banking and the proliferation of APIs (Application Programming Interfaces). This evolution allows for seamless integration of banking data with third-party services, fostering an environment ripe for innovation and customization.

Financial institutions can now collaborate more effectively with fintech startups, offering customers a broader range of services, from personalized banking experiences to streamlined payment systems. This synergy not only enhances user satisfaction but also propels the industry towards a more open, interconnected future. By leveraging the power of APIs, banks and service providers can quickly adapt to market demands, ensuring they remain competitive in an ever-changing digital world.

The Emergence Of Open Banking

The financial landscape is undergoing a major transformation. This change comes with the rise of open banking. Open banking uses APIs to connect banks, third-parties, and customers. It unlocks a treasure trove of financial data. This new era in banking promises innovation and new services for customers.

Driving Factors Behind Open Banking

Several key elements are pushing the open banking movement forward. Firstly, customer demand for seamless services is soaring. People want their financial data to work for them. They seek personalized services. Regulatory changes also play a role. Laws like PSD2 in Europe encourage open banking. Lastly, tech advancements make sharing data safer and more efficient. These factors together are driving banks towards an open ecosystem.

- Customer expectations for quick, tailored services

- Regulatory support such as PSD2 and open banking standards

- Technological progress in APIs and data security

Impact On Traditional Banking Models

Open banking is reshaping how traditional banks operate. It introduces a shift from closed systems to open platforms. Banks must now share their data with third-party providers. This encourages competition. It leads to better products and services. Banks are thus evolving. They are becoming more like tech companies, focusing on innovation and customer experience.

| Traditional Banking | Open Banking |

|---|---|

| Closed systems | Open platforms |

| Limited services | Wide range of services |

| Slow innovation | Rapid innovation |

| Bank-centric | Customer-centric |

In conclusion, open banking is not just a trend. It’s a new standard in financial services. It empowers customers and transforms the industry. Traditional banks are adapting. They are embracing this change to stay relevant in the digital age.

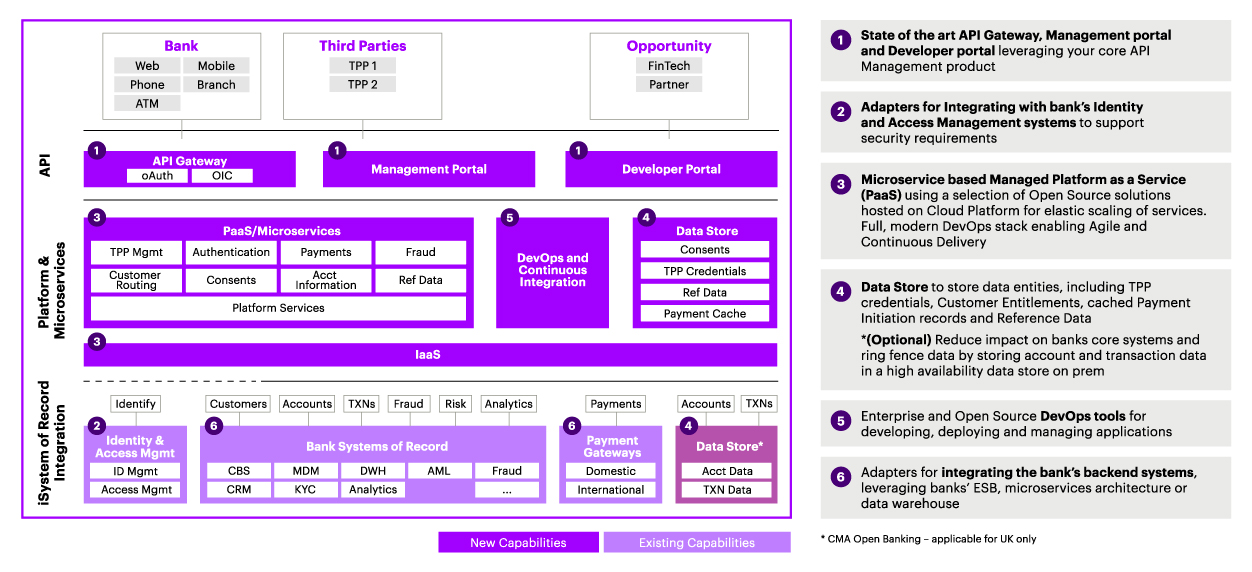

Credit: www.infopulse.com

Apis: The Building Blocks Of Open Banking

Imagine a world where your financial services are seamlessly connected, tailored to your needs, and accessible with a simple click. This is the power of Open Banking, and APIs are its foundation.

What Are Apis?

APIs, or Application Programming Interfaces, are the tools that allow different software systems to communicate. Think of APIs as the messengers carrying your requests to a bank and then bringing back the bank’s response to you.

How Apis Fuel Financial Services

In the finance world, APIs act as the bridge between your bank and the applications you love. They enable new products and services that can help you manage money easier.

- Real-time transactions: APIs let you see your spending as it happens.

- Personal finance management: They connect your bank data with budgeting apps.

- Smooth payments: APIs make online checkouts fast and secure.

With APIs, new finance tools emerge daily, creating a world of options for everyone.

The Regulatory Landscape For Open Banking

The Regulatory Landscape for Open Banking has transformed the financial industry. Governments and financial authorities worldwide have set rules that enable secure data sharing. This sharing boosts innovation and creates new financial products and services. Let’s explore key regulations shaping this landscape.

Psd2 And Its Global Influence

The Payment Services Directive 2 (PSD2) is a pivotal piece of European legislation. It paves the way for open banking by allowing non-banks access to bank data, with user consent. This directive has influenced countries globally to adopt similar open banking frameworks, fostering a wave of fintech innovation.

Compliance And Security Concerns

With new rules come new challenges. Compliance and security are at the heart of open banking regulations. Banks and fintechs must adhere to strict standards to protect consumer data. They implement robust security measures like encryption and multi-factor authentication.

| Security Measure | Purpose |

|---|---|

| Encryption | Protects data in transit |

| Multi-factor Authentication | Ensures user identity |

| Regular Audits | Checks system integrity |

Entities must also conduct regular audits and have data breach plans in place. These actions build trust and ensure a secure open banking ecosystem.

Innovative Services Enabled By Open Banking

The advent of open banking has revolutionized the way financial services operate, inviting a wave of innovation. By leveraging the power of Application Programming Interfaces (APIs), open banking dismantles barriers to financial data, fostering an ecosystem where new products and services can flourish. These services aim to improve user experience, financial management, and access to credit.

Personal Financial Management

Open banking reshapes personal finance with user-centric solutions. Customers gain comprehensive insights into their finances. This transparency enables better budgeting and spending habits.

- Account aggregation: View all bank accounts in one place.

- Expense tracking: Monitor spending patterns easily.

- Savings goals: Set and achieve financial targets.

Enhanced Lending Decisions

Lenders now make more informed decisions swiftly. Access to financial data ensures accurate creditworthiness assessments. This leads to fairer loan terms for customers.

| Data Points | Benefits |

|---|---|

| Income verification | Fast and secure checks |

| Financial behavior | Better risk assessment |

| Credit history | Personalized offers |

Api Economy: Creating A Platform For Collaboration

The API Economy is a game-changer in the financial world. It turns competition into collaboration. Banks and fintech companies use APIs to build new products and services.

The Role Of Fintech Startups

Fintech startups are at the heart of the API revolution. They bring fresh ideas to the table. These companies create tools that banks and other businesses use. They make banking easy and personal.

- Quick to adapt: Startups move fast to meet customer needs.

- Innovation hubs: They test and try new financial solutions.

- User-focused design: Startups make apps that are easy and fun to use.

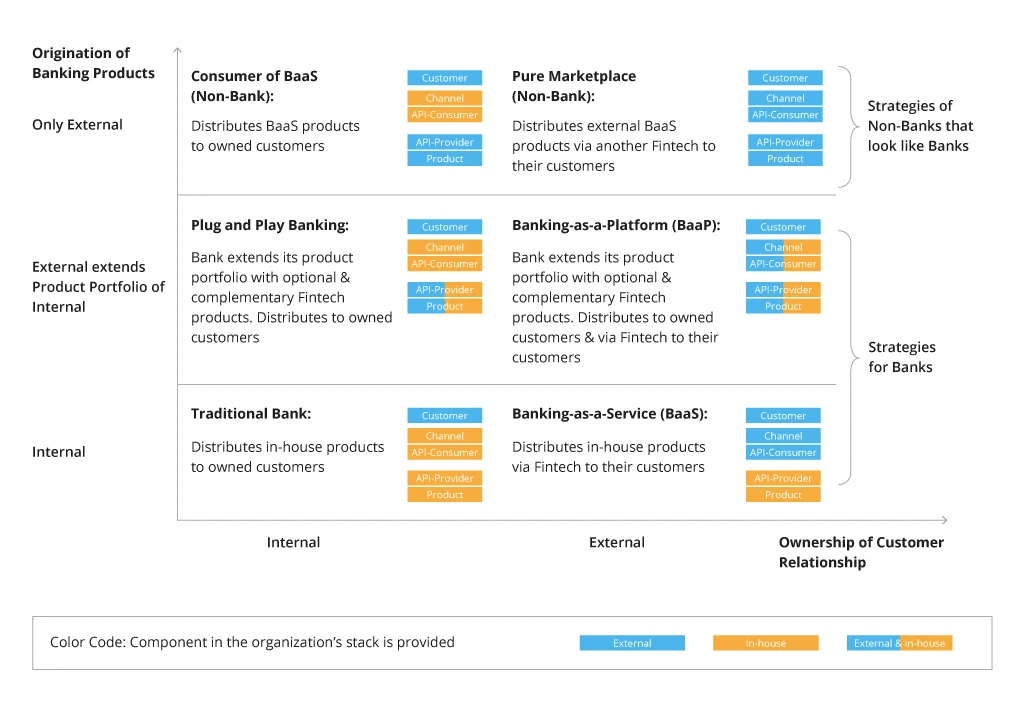

Banking As A Service (baas)

Banking as a Service is a big step forward. Banks open their systems to others through APIs. This lets companies offer banking without being banks.

| Feature | Benefit |

|---|---|

| Easy Integration | Companies can add banking features fast. |

| Customization | Services are made to fit customer needs. |

| Cost-effective | It saves money on building from scratch. |

With BaaS, everyone wins. Customers get better services. Businesses grow. Banks reach new markets.

The Customer Experience Revolution

Open Banking and API-driven innovation are not just buzzwords. They are changing how we handle money. Banks and fintech companies use these technologies to make new products and services. This change focuses on the customer experience. Let’s explore how this revolution brings personalization and easy access to financial services.

Personalization Through Data

With Open Banking, financial services become more tailored to individual needs. Companies can see your financial habits. They use this info to suggest the right services for you. This makes banking feel like it’s made just for you.

- Recommend products based on spending patterns

- Alerts for deals and savings opportunities

- Customized budgeting tools to manage money better

Convenience And Accessibility

Banking is now at your fingertips, anytime, anywhere. Open Banking APIs allow you to access services through different apps. This makes life easier. You can do banking without visiting a branch. Check balances, pay bills, or send money with just a few clicks.

| Service | Benefit |

|---|---|

| 24/7 account access | Manage money on your schedule |

| Real-time transactions | See updates instantly |

| Multi-platform integration | Use banking services across different apps |

Challenges And Considerations In Open Banking

Open banking revolutionizes finance, yet it brings challenges. Understanding these is vital for success.

Data Privacy And Protection

Customers’ data safety is crucial in open banking. Banks and third-parties must protect this information. The challenge is to maintain trust while sharing data across platforms.

- Strict access controls

- Encryption methods

- Regular audits

These measures ensure data stays safe.

Mitigating Fraud And Cybersecurity Risks

Open banking increases exposure to fraud and cyber threats. Organizations must stay ahead of hackers. This means investing in:

| Security Feature | Benefit |

|---|---|

| Advanced authentication | Verifies user identities |

| Real-time monitoring | Detects unusual activities |

| Incident response plans | Prepares for potential breaches |

Regular updates and employee training are also key.

:max_bytes(150000):strip_icc()/open_banking-final-8af075f74bb54196bbbd342f717e7716.jpg)

Credit: www.investopedia.com

The Future Landscape Of Financial Services

The financial world is on the brink of a major transformation. Open banking and API-driven innovation stand at the forefront, reshaping how we interact with financial services. This shift promises a future where banking is more accessible, personalized, and efficient. Let’s explore what this could look like.

Predictions For Open Banking

- Greater control for users over their financial data.

- Banks will partner with fintech companies more often.

- Real-time payments will become the norm.

- Personalized financial advice will be powered by AI algorithms.

- Security measures will be enhanced to protect user data.

Long-term Implications For The Industry

Open banking is not just a trend; it’s the future. It will change how banks operate and how services are delivered.

| Aspect | Impact |

|---|---|

| Customer Experience | More tailored services will improve satisfaction. |

| Competition | New players will emerge, challenging traditional banks. |

| Innovation | Banks will need to innovate continuously to stay relevant. |

| Regulation | Regulators will introduce new frameworks to ensure safety. |

Open banking will lead to a democratization of financial services. Customers will enjoy a new level of empowerment. The industry must adapt to this new era or risk being left behind.

Credit: bankingblog.accenture.com

Frequently Asked Questions

How Api Is Used In Open Banking?

APIs in open banking enable secure data sharing between financial institutions and third-party providers, facilitating innovative banking services and improved customer experiences.

What Is An Api Strategy For Banks?

An API strategy for banks involves creating a framework for developing, sharing, and managing APIs to enhance banking services, improve customer experiences, and foster innovation through secure data exchange and third-party collaborations.

How Will Open Apis Help In Enhancing The Banking Experience?

Open APIs enable seamless integration of banking services with third-party apps, offering customers personalized experiences and innovative features.

How Is Open Banking Innovative?

Open banking is innovative as it enables secure data sharing between financial institutions and third-party apps, fostering personalized services and financial management solutions. It revolutionizes user experience by offering enhanced transparency and control over personal financial data.

Conclusion

Embracing open banking and API-led innovation marks a turning point for the financial sector. These technologies are catalysts for a wave of fresh, user-centric products and services. As we witness this transformative era, businesses and consumers alike stand to gain from the unprecedented levels of accessibility, efficiency, and customization on offer.

Let’s continue to innovate and watch the landscape of financial services evolve.