Banks and fintech firms are collaborating to spur innovation, enhancing customer experiences and operational efficiency. These partnerships are rapidly transforming the financial landscape.

The financial sector is witnessing a revolutionary synergy as traditional banks and innovative fintech companies merge their strengths. By combining the vast customer base and regulatory expertise of established banks with the agility and tech prowess of fintechs, this alliance is paving the way for cutting-edge financial solutions.

Customers stand to benefit from more personalized banking experiences, streamlined services, and improved accessibility. This blend of stability and innovation is not just reshaping how we bank, but also setting new standards for the industry’s future. As these collaborations deepen, they hold the promise of delivering financial products that are both more responsive to user needs and more secure.

The Rise Of Fintech

The Rise of Fintech is reshaping the financial landscape. Innovative technologies are emerging. They are changing how we handle money. Banks are now partnering with fintech firms. This fusion brings new financial products. It also improves customer experiences. Let’s dive into the world of financial technology.

Emergence Of Financial Technology

Fintech, short for financial technology, has grown rapidly. It uses technology to improve financial activities. Fintech startups are agile and innovative. They offer services from mobile banking to cryptocurrency. This sector attracts investments worldwide. Fintech solutions reach underserved markets. They offer easy access to financial services.

Impact On Traditional Banking

Traditional banks face a challenge. Fintech companies are fast and customer-centric. Banks are now embracing fintech partnerships. This collaboration leads to better services. Customers enjoy faster transactions and personalized banking. Banks can now offer cutting-edge solutions. These solutions keep them competitive in a digital world.

- Better customer service: Fintech innovations lead to quicker, more efficient service.

- Advanced security: Fintech introduces improved security features.

- New banking features: Features like mobile wallets and P2P payments are now common.

Credit: personetics.com

Traditional Banks Vs. Fintech Firms

The financial landscape is shifting. Traditional banks and fintech firms are now in the same arena. Each brings unique strengths to the table. But they differ vastly in their approach to finance and technology.

Differences In Approach

Banks focus on stability and reliability. They have been around for centuries. People trust them with their money. Fintech firms, on the other hand, embrace innovation and user experience. They are new kids on the block. But they are quick and adapt fast.

- Traditional banks: Often slow to change. They have large customer bases. But, they are burdened by legacy systems.

- Fintech firms: Agile and tech-savvy. They use the latest technologies. They aim to disrupt the status quo.

Competitive Landscape

The competition is fierce. Banks and fintech firms are battling for market share. Both want to lead in innovation.

| Banks | Fintech Firms |

|---|---|

| Large customer bases | Niche markets |

| Regulatory expertise | Technology-first approach |

| Physical branches | Digital platforms |

Banks have the trust of many. They have years of experience. Fintech firms bring fresh ideas. They attract tech-savvy customers. This creates a landscape where both can thrive. They just need to play to their strengths.

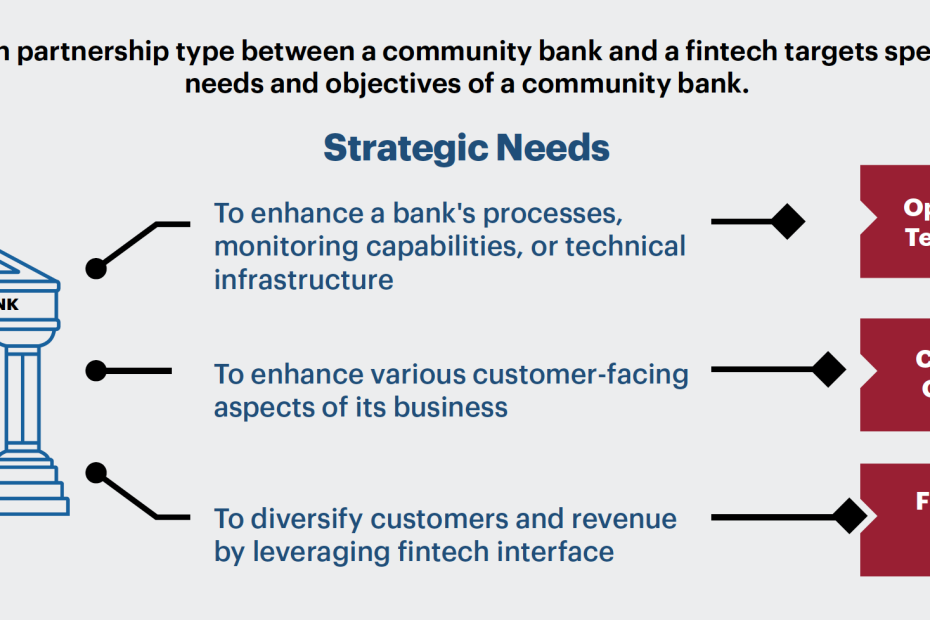

Motivations For Collaboration

The push for innovation within the financial sector has led banks and fintech firms to join hands. These collaborations aim to combine the strengths of both players. Traditional banks offer a vast customer base and deep regulatory experience. Fintech firms bring cutting-edge technology and agility. Together, they seek to transform the finance world.

Innovative Solutions

Banks have a strong desire to stay ahead in the digital race. Fintech firms specialize in creating fresh, tech-driven services. This partnership fosters a hotbed for innovative solutions that can redefine banking.

- Enhanced mobile banking apps

- Streamlined payment systems

- Personalized financial advice through AI

Expanding Customer Base

Both banks and fintech firms aim to reach new markets. By working together, they can offer services to those previously underserved. Banks gain access to fintech’s innovative platforms. Fintechs leverage the bank’s established reputation.

| Bank’s Gain | Fintech’s Gain |

|---|---|

| Access to new tech | Established trust |

| Agile development | Customer base growth |

Synergies In Bank-fintech Partnerships

The landscape of financial services is rapidly changing. Banks and fintech firms are joining forces. These partnerships bring together the best of both worlds. They create powerful synergies. Let’s explore these exciting collaborations.

Combining Strengths

Traditional banks have robust infrastructure. They have trust from years of operation. Fintech companies are agile and innovative. When they partner, they combine strengths. Banks offer large customer bases. Fintech provides cutting-edge technology. This union leads to growth and better services.

- Banks bring: Customer trust, regulatory expertise, and wide reach.

- Fintech offers: Innovation, modern solutions, and technical agility.

Enhanced User Experience

Customers expect seamless services. They want easy-to-use financial tools. Bank-fintech partnerships focus on user experience. They streamline processes. They create user-friendly interfaces. Customers enjoy faster, more convenient services.

| Benefits | Features |

|---|---|

| Speed | Instant transactions |

| Accessibility | 24/7 banking |

| Convenience | Mobile-first approach |

Challenges In Forming Partnerships

Partnerships between banks and fintech firms are crucial for innovation. Yet, they face challenges. These challenges can slow progress. Understanding them is key to successful collaboration.

Regulatory Hurdles

Regulations can be tricky for banks and fintechs. Each has different rules to follow. Banks often face stricter regulations. Fintechs are known for rapid innovation. Aligning these can be tough.

- Compliance issues: Both must comply with finance laws.

- Licensing: Fintechs may need new licenses to partner with banks.

- Data protection: Sharing customer data comes with risks.

Cultural Differences

Banks and fintechs work differently. Banks have established ways. Fintechs move fast and break things. This can cause clashes.

- Risk tolerance: Banks usually avoid risks. Fintechs often embrace them.

- Innovation speed: Fintechs innovate quickly. Banks may be slower.

- Decision-making: Banks often have complex processes. Fintechs can decide quickly.

Credit: fastercapital.com

Success Stories Of Collaboration

The landscape of financial services is changing rapidly, with banks and fintech firms finding common ground. Their collaboration is a tale of synergy, bringing together the best of both worlds. Here, we explore some success stories that highlight the power of partnership in driving innovation within the banking sector.

Case Studies

- JP Morgan Chase & OnDeck: This partnership allowed JP Morgan to leverage OnDeck’s lending technology. As a result, they offered faster loan approvals to small businesses.

- BBVA & Holvi: BBVA acquired Holvi, a Finnish online banking service for entrepreneurs. This move helped BBVA expand its digital offerings in Europe.

- Goldman Sachs & Apple: They joined forces to launch the Apple Card. This card offers a seamless and secure payment experience with benefits tied to the Apple ecosystem.

Key Takeaways

These collaborations showcase critical benefits:

- Increased Speed: Banks can quickly deliver services with fintech innovation.

- Enhanced Customer Experience: Customers enjoy better, more convenient services.

- Expanded Reach: Banks tap into new markets and customer segments.

Future Of Bank-fintech Alliances

The collaboration between banks and fintech firms is reshaping the financial landscape. These partnerships promise to bring forth a wave of innovative solutions. They blend traditional banking’s robustness with the agility of fintech. This fusion is the key to meeting the evolving needs of consumers and businesses alike.

Emerging Trends

Several trends are surfacing as banks and fintechs continue to join forces:

- Integration of Digital Wallets: Banks are adopting digital wallets powered by fintech to simplify transactions.

- AI-driven Financial Services: Artificial intelligence is enabling personalized banking experiences.

- Blockchain for Security: Blockchain technology is being used to enhance security and transparency.

These trends indicate a future where finance is more accessible, secure, and user-centric.

Predictions For The Industry

Industry predictions focus on the impact of bank-fintech collaborations:

| Year | Prediction |

|---|---|

| 2023 | More banks will offer fintech services like real-time payments. |

| 2025 | Fintech will drive over half of banking transactions. |

| 2030 | Most financial products will be managed through fintech platforms. |

These predictions suggest a future where fintech is not just an option, but a necessity for banks.

Credit: www.worldfinance.com

Strategies For Successful Partnerships

Collaboration between banks and fintech firms ignites innovation. Understanding how these partnerships can thrive is critical. Let’s explore the blueprint for success.

Best Practices

- Clear Objectives: Define goals for both parties.

- Open Communication: Regular, honest dialogues build trust.

- Regulatory Compliance: Stay ahead of legal frameworks.

- Customer-Centric Approach: Focus on user experience.

- Flexibility: Adapt to market and technology changes.

Maintaining A Competitive Edge

Continuous Innovation: Embrace new tech and ideas.

Data-Driven Decisions: Use insights to guide strategies.

Agile Methodologies: Enable rapid development cycles.

Partnership Synergy: Leverage each other’s strengths.

Frequently Asked Questions

What Is The Collaboration Between Banks And Fintech?

The collaboration between banks and fintech involves partnerships for innovative financial services, combining traditional banking expertise with cutting-edge technology from fintech companies.

How Do Fintech Companies Work With Banks?

Fintech companies collaborate with banks by integrating innovative technology to streamline financial services. They provide advanced solutions for payments, lending, and security, enhancing the traditional banking experience. This partnership often leads to improved customer service and efficient banking operations.

What Is Fintech Partnership Strategy?

A fintech partnership strategy involves collaborating with financial technology companies to enhance services, innovate products, and expand market reach. It’s a plan for mutual growth and customer value creation.

What Are The Drivers Of Fintech Innovation?

Fintech innovation is driven by technological advancements, consumer demand for convenience, increased mobile device usage, supportive regulatory frameworks, and the need for financial inclusion.

Conclusion

The landscape of financial services is ever-evolving, with bank and fintech collaborations at the forefront. These strategic alliances are not just trends but essential steps towards reshaping customer experiences and creating robust financial ecosystems. As we have explored, such partnerships hold the key to unlocking innovative solutions and fostering growth in an increasingly digital world.

Embrace the synergy of traditional banking with fintech agility to stay ahead in the financial revolution.