In the evolving financial transaction landscape, security and innovation are paramount. Embrace technology advancements and regulatory compliance to stay ahead.

The financial industry is rapidly transforming, driven by technological innovation and changing consumer expectations. This dynamic environment presents both challenges and opportunities for businesses and consumers alike. Staying informed about the latest trends is crucial for anyone looking to navigate this complex terrain successfully.

With a focus on enhancing security measures and complying with evolving regulations, organizations can safeguard their operations and build trust with their clients. Embracing cutting-edge technologies such as blockchain, AI, and digital currencies will enable companies to offer more efficient and secure transaction experiences. As the financial landscape continues to shift, it’s essential to prioritize these key areas to remain competitive and meet the demands of a modern economy.

Emerging Financial Landscapes

The financial world is rapidly changing. New technologies and global shifts are shaping how we think about money. Let’s dive into the emerging financial landscapes and explore these dynamic changes.

Shifts In Global Economy

The global economy is witnessing significant shifts. Nations are increasingly interconnected. Trade barriers are falling. Consumer behavior is evolving. These changes impact financial transactions worldwide. They demand adaptability and strategic foresight from businesses and individuals alike.

- Trade agreements reshape market access.

- Consumer trends influence payment solutions.

- Regulatory changes create new compliance requirements.

Rise Of Digital Currencies

Digital currencies are transforming the financial landscape. Bitcoin and other cryptocurrencies offer decentralized alternatives to traditional banking. They challenge existing financial systems. Their rise prompts discussions on regulation, security, and the future of money.

| Currency | Features | Impact |

|---|---|---|

| Bitcoin | Decentralized, limited supply | Influences investment strategies |

| Ethereum | Smart contracts, DApps | Enables new business models |

| Stablecoins | Pegged to fiat currencies | Reduces volatility concerns |

Credit: www.mdpi.com

Technological Advancements In Finance

The finance sector is undergoing rapid change thanks to technology. New tools and systems emerge regularly. They make transactions faster, more secure, and accessible to all. Let’s explore key tech trends shaping finance today.

Impact Of Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are big players in finance. They bring smart automation to the table. Banks and firms use these to predict market trends. They also help in fraud detection. Let’s look at some ways AI and ML are changing the game:

- Personalized Banking: Chatbots provide custom support to users.

- Risk Management: AI models predict loan defaults better than old methods.

- Algorithmic Trading: ML algorithms can make trades in milliseconds.

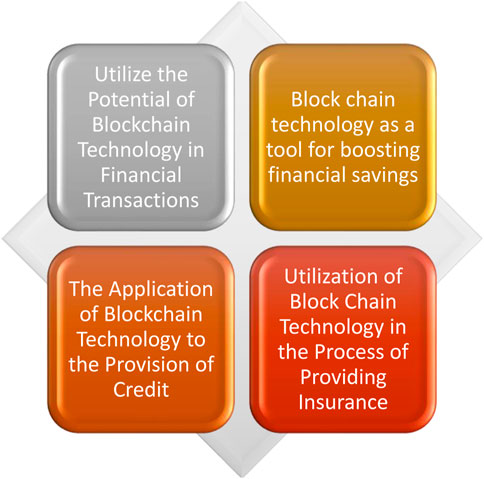

Blockchain Revolution

Blockchain technology is more than just Bitcoin. It’s a new way to track transactions. It’s transparent and very secure. Many industries are adopting blockchain. Here’s how it’s changing finance:

| Area | Impact |

|---|---|

| Payments | Instant and cross-border with lower fees. |

| Smart Contracts | Automate agreements with no middlemen. |

| Identity Verification | Reduce fraud with secure digital IDs. |

Changing Regulatory Environments

The financial transaction landscape is in constant flux. One crucial aspect is the Changing Regulatory Environments. Businesses must stay alert. They must adapt. This means understanding and aligning with new regulations. It’s vital for compliance. It’s vital for success.

Global Compliance Challenges

Financial players face a complex web of regulations. These vary by country. They change frequently. Staying ahead is daunting but necessary. The key challenges include:

- Data protection laws that require robust security measures.

- Anti-money laundering (AML) directives that demand stringent checks.

- Payment Services Directives (PSD2) in Europe that redefine banking rules.

- Cross-border regulations that complicate international transactions.

Adapting To New Policies

Adaptation is not just important; it’s a survival skill. Here’s how businesses can stay compliant:

- Invest in compliance training. Ensure teams know the rules.

- Use technology. Automate to manage regulatory changes.

- Stay informed. Follow updates from financial authorities.

- Seek expert advice. Work with compliance professionals.

Environmental, Social, And Governance (esg) Criteria

The financial world is changing fast. Smart investors now look beyond just profits. They check how companies perform on environmental, social, and governance (ESG) factors. These factors can affect a company’s risk and growth. Let’s dive into how ESG shapes today’s investment strategies and reporting standards.

Incorporating Esg In Investment Strategies

Investors use ESG to find companies that are safe to invest in for the long term. They want businesses that are kind to the environment, good to people, and run fairly. Here are key steps for adding ESG to investment plans:

- Assess ESG factors: Look at how a company does in areas like pollution, worker treatment, and leadership honesty.

- Choose ESG-focused funds: Pick mutual funds or ETFs that track ESG-friendly companies.

- Engage in shareholder advocacy: Use your power as a shareholder to push for better ESG practices.

Esg Reporting Standards

Companies now tell investors how they do on ESG. They use special rules to share this info. These rules make sure everyone tells the truth and makes it easy to compare different companies. Here’s what good ESG reports have:

| Report Section | Details Included |

|---|---|

| Environmental Impact | Energy use, waste, pollution, and how they’re reducing harm to nature. |

| Social Responsibility | How they treat workers, support communities, and keep products safe. |

| Governance Practices | Company rules, how they avoid conflicts of interest, and make decisions fairly. |

Good reports follow rules set by groups like the Sustainability Accounting Standards Board (SASB) or the Global Reporting Initiative (GRI). This helps everyone trust the info they read.

The Surge Of Fintech Innovations

Financial technology, or ‘fintech’, is changing the way we handle money. New tools make transactions faster and simpler. This wave of change brings exciting developments. Let’s explore key innovations reshaping the financial landscape.

Mobile Payments Transformation

Smartphones have become wallets. You can pay for coffee, or send cash to friends with a few taps. Businesses now must adapt to mobile payment demands. This shift towards digital wallets is vital for staying competitive.

- NFC technology enables contactless payments.

- QR codes provide a quick scan-and-pay option.

- Apps like Apple Pay and Google Wallet are becoming common.

Peer-to-peer Lending Platforms

Peer-to-peer (P2P) platforms are booming. They link borrowers to lenders directly. This cuts out traditional banks. Loans are faster and often cheaper. P2P is a game-changer for both personal and business finance.

| Benefits | Examples |

|---|---|

| Lower interest rates | Prosper, LendingClub |

| Quick approval | Funding Circle, Zopa |

| Accessible online | Kiva, Upstart |

Remember, fintech is not just a trend. It is the new normal in finance. Embrace these changes to stay ahead.

Risk Management Evolutions

As the financial transaction landscape continuously evolves, effective risk management remains a cornerstone of a robust financial system. New technologies and methods bring both opportunities and challenges. Staying ahead of these developments is crucial for any financial institution looking to safeguard its operations and reputation. Let’s delve into the latest advancements in risk management.

Cybersecurity Threats

The digital era brings advanced threats to financial security. Banks and businesses must adapt quickly to stay safe. Here are key points:

- Phishing attacks are more sophisticated than ever, tricking even the vigilant.

- Malware can cripple entire systems, making up-to-date software a must-have.

- Regular training for staff on cyber threats is vital for defense.

Organizations must invest in cutting-edge security tools to detect and prevent breaches.

Data Privacy Concerns

Customers value privacy, making data protection essential. Important measures include:

- Implementing strict access controls to sensitive information.

- Ensuring compliance with global data protection regulations.

- Adopting encryption for all customer data transactions.

Regular audits and updates to privacy policies are also key to maintaining trust.

Investment Strategies For The New Age

Adapting to the dynamic financial landscape requires fresh investment strategies. The new age brings technologies and trends that shape how we invest. The focus now is on smart, diverse portfolios that can weather market volatility. Let’s explore effective strategies to stay ahead in this evolving arena.

Portfolio Diversification Tactics

Diversification stands as a pillar in investment. It minimizes risks and taps into various opportunities. A well-diversified portfolio includes a mix of stocks, bonds, and other assets. This blend helps cushion against market downturns.

Consider these tactics:

- Spread investments across different sectors.

- Include international stocks for global exposure.

- Add bonds to balance stock market swings.

- Consider alternative investments like real estate or commodities.

A diverse portfolio can help protect and grow your investments.

Assessing Cryptocurrency Investments

Cryptocurrencies are the latest addition to the investment world. They offer high potential returns but come with high risks. Assess them carefully before investing.

Key points in cryptocurrency assessment include:

| Factor | Importance |

|---|---|

| Volatility | Expect price swings and plan for them. |

| Regulation | Stay informed on laws affecting crypto. |

| Technology | Understand the tech behind the currency. |

| Market Trends | Follow trends to make informed decisions. |

Research thoroughly to navigate the crypto space with confidence.

Credit: www.mdpi.com

Future Of Finance Jobs

The financial sector stands at the brink of a transformative era. The ‘Future of Finance Jobs’ is a dynamic field. It will require a blend of new skills and technological understanding. As the industry evolves, so does the career landscape for finance professionals.

Skillsets For Tomorrow

Finance professionals must adapt to stay relevant. Key skills include:

- Data analysis: Interpreting complex data sets is crucial.

- Technical proficiency: Understanding fintech and blockchain matters.

- Soft skills: Communication and problem-solving are vital.

- Adaptability: The ability to learn and apply new technologies is key.

Automation And The Workforce

Automation is changing finance jobs. Workers must embrace technology. Skills for the future include:

| Technology Skill | Importance |

|---|---|

| AI and Machine Learning | High |

| Robotic Process Automation | Medium |

| Cloud Computing | High |

Workers must learn new software and tools. They must adapt to new roles created by automation. This shift is not an end to jobs but a change in job types.

Credit: www.linkedin.com

Frequently Asked Questions

What Is The Financial Landscape?

The financial landscape refers to the overall economic environment, comprising various markets, institutions, and instruments involved in finance.

What Is The Strongest Current Trend In Payment Processing?

The strongest trend in payment processing is the rise of mobile payments and digital wallets, offering speed and convenience.

What Is The Purpose Of A Financial Transaction?

The purpose of a financial transaction is to exchange funds between parties, either as payment for goods and services or to fulfill contractual obligations.

What Are The Different Types Of Financial Transactions?

There are four main types of financial transactions: deposits, withdrawals, transfers, and payments. Each involves the exchange of money between parties.

Conclusion

Embracing the dynamic financial transaction sector is crucial. Prioritize secure, efficient systems and stay informed on regulatory changes. Innovation in payment technologies offers competitive advantages. To thrive, adaptability and customer trust are essential. Keep these focal points in mind to navigate the financial future successfully.