The digital and mobile payment industry is experiencing unprecedented growth. Consumers are rapidly adopting these convenient payment methods.

Embracing the digital revolution, businesses and consumers alike are shifting towards cashless transactions. This transformation is fueled by the rise in smartphone usage and the demand for quick, secure payment options. Digital wallets, contactless cards, and mobile banking apps are becoming everyday tools for millions.

The convenience of tapping to pay or sending money in seconds has altered the landscape of financial exchanges. Notably, this shift is not just a trend but a significant move towards a more digitalized economy. This surge in digital payment solutions offers businesses new opportunities to streamline their operations and enhance customer experience. As we delve into the intricacies of this financial evolution, it’s clear that the way we think about money and transactions is changing forever.

Credit: www.capitalontap.com

The Shift To Cashless Transactions

The way we pay for goods and services has dramatically changed. A significant shift to cashless transactions is unfolding across the globe. People are leaving cash behind in favor of digital and mobile payment options. This trend is not just a fad. It is a sign of a digital revolution that’s reshaping our financial landscape.

Factors Driving Digital Payment Adoption

Several key factors are fueling the switch from physical currency to digital payments:

- Convenience: Digital payments are instant and can be made anytime, anywhere.

- Security: They reduce the risk of theft and fraud compared to carrying cash.

- Incentives: Rewards and cashback offers make digital payments more attractive.

- Technological advancements: Smartphones and fintech innovations have made digital payments more accessible.

- Government policies: Many governments encourage digital payments to improve transparency and reduce corruption.

Comparing Cash Vs. Digital Payment Methods

Understanding the differences between cash and digital payments helps us appreciate the shift to cashless transactions.

| Cash Payments | Digital Payments |

|---|---|

| Physical exchange of currency | Electronic transfer of funds |

| Limited to face-to-face transactions | Can be done remotely |

| Harder to track and manage | Easier budgeting and tracking |

| Greater risk of theft or loss | Enhanced security features |

| No rewards or cashback | Potential for incentives |

As we compare, it’s clear that digital payment methods offer advantages that cash cannot match. These benefits are leading more people to choose digital wallets, online banking, and mobile payment apps over traditional cash transactions.

Evolving Payment Technologies

The world of transactions is changing fast. Digital and mobile payments are the new norms. Let’s dive into the technologies making this possible.

Near Field Communication (nfc) And Its Role

NFC transforms how we pay. It lets devices communicate when they’re close. Phones, tablets, and payment terminals use it. Just tap your phone, and you’ve paid. It’s that simple.

- Quick and secure: NFC payments are fast and protect your data.

- Easy to use: No swiping or inserting cards. A simple tap does the job.

- Widely accepted: Many stores now have NFC-ready terminals.

The Emergence Of Blockchain In Payments

Blockchain is a game-changer. It’s the technology behind cryptocurrencies. Now, it’s shaping how we transfer money.

| Benefits | How It Works |

|---|---|

| Transparency | Every transaction is recorded and visible. |

| Security | Data is decentralized, making fraud harder. |

| Lower Costs | Fewer middlemen mean fewer fees. |

Blockchain allows direct payments. It doesn’t matter where you are in the world.

Mobile Payments Leading The Charge

Mobile Payments Leading the Charge revolutionizes how we handle money. Gone are the days of cash and clunky credit card machines. Today, a tap on a smartphone sends payments swiftly. This shift towards digital convenience is not just a trend; it’s the new norm for consumers and businesses alike.

Rise Of Mobile Wallets And Apps

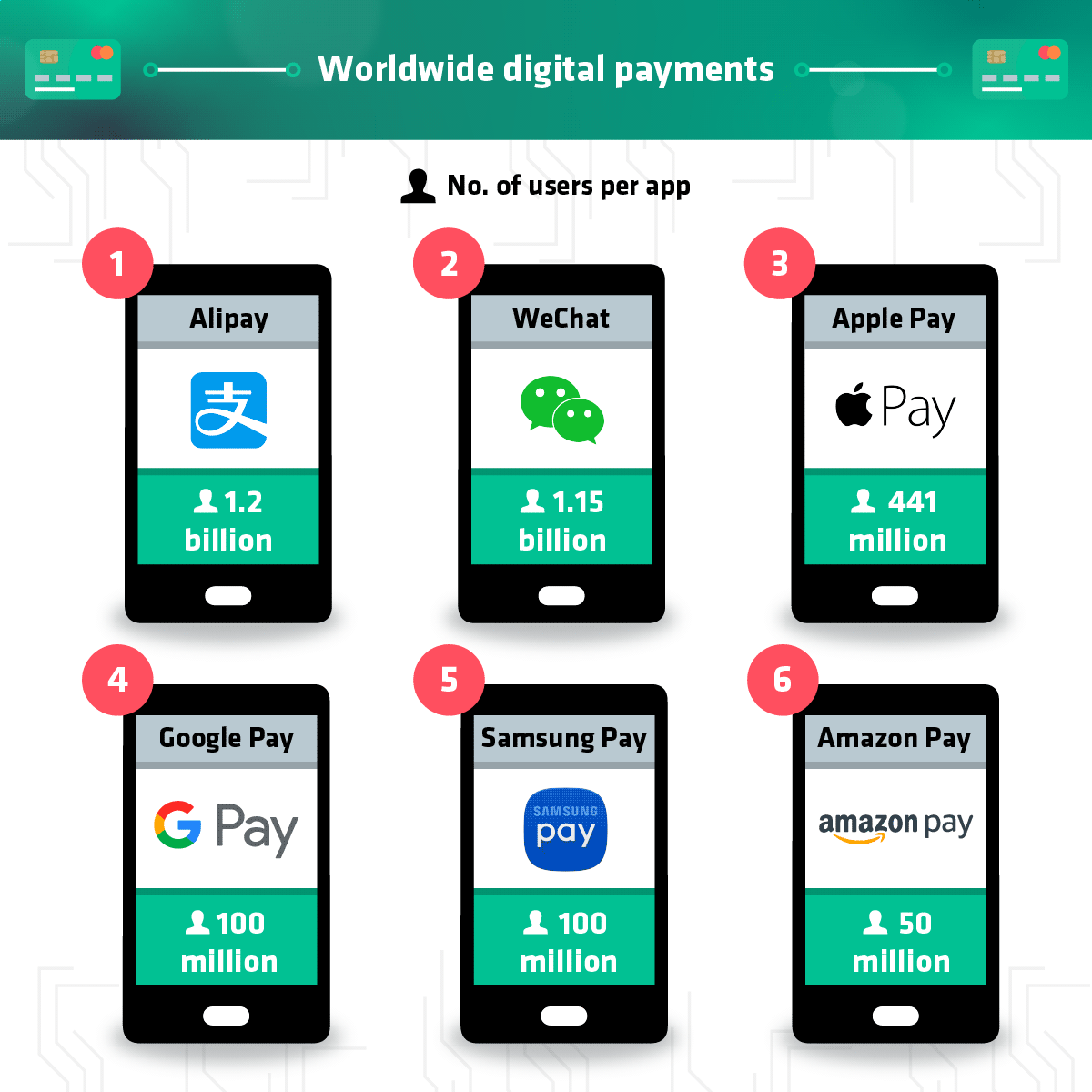

Mobile wallets and apps have taken center stage in the digital payment arena. Services like Apple Pay, Google Wallet, and Samsung Pay transform smartphones into digital wallets, allowing users to store credit card information securely and make transactions with a single tap. These apps have seen exponential growth, thanks to:

- Convenience: Paying with a phone is faster than traditional methods.

- Universal acceptance: More stores now welcome mobile payments.

- Rewards: Users often get exclusive discounts and cashback offers.

Mobile Payment Security Measures

Security is a top priority in mobile payments. To protect users, mobile payment platforms employ:

- Encryption: This turns sensitive data into unreadable code.

- Tokenization: It replaces card details with a unique symbol for each transaction.

- Biometrics: Fingerprint and facial recognition ensure the user’s identity.

These measures ensure that even if a phone is lost or stolen, the risk of fraudulent transactions is minimal. Users can feel confident that their financial information remains safe when they use mobile payments.

Credit: blog.repay.com

Global Trends In Digital Payments

The digital payment landscape is rapidly evolving. With technology advancing, more people are choosing digital and mobile payments over traditional methods. This shift is driven by the convenience, speed, and security these platforms offer. Consumers globally are quickly embracing this change, setting new trends in the financial world.

Adoption Rates Across Different Regions

Digital payment adoption varies worldwide. Factors include technology access, economic development, and regulatory environments.

| Region | Adoption Rate |

|---|---|

| Asia-Pacific | High |

| Europe | Medium to High |

| Americas | Medium |

| Africa | Low to Medium |

| Middle East | Low |

Case Studies: Mobile Payments In Asia And Africa

Asia and Africa present unique case studies in mobile payments, each with distinct success stories.

- Asia: Boasts a robust mobile payment ecosystem. China leads with platforms like Alipay and WeChat Pay. These services have millions of users.

- Africa: Known for mobile money solutions like M-Pesa. It revolutionized banking in Kenya, with high impact on daily transactions.

The Impact On Banking And Financial Services

The digital age is reshaping the way money moves. Banks and financial institutions face new challenges and opportunities. Let’s explore the profound impact on the sector.

Changes In Traditional Banking Models

Banking is evolving. Physical branches give way to online platforms. Customers enjoy banking from anywhere, anytime. This shift demands banks to rethink strategies. They must embrace technology to stay relevant.

- Reduction in brick-and-mortar locations

- Increased investment in digital infrastructure

- Personalized services through AI and data analytics

Customers expect convenience. Banks are responding with 24/7 access to services. Traditional services like depositing checks are now digital. This leads to cost savings and efficiency gains for banks.

Fintech Innovations In Financial Transactions

Fintech companies are at the forefront of this revolution. They offer cutting-edge payment solutions. These innovations cater to a tech-savvy user base.

| Service | Benefit |

|---|---|

| Mobile Wallets | Fast and secure transactions |

| Peer-to-Peer Payments | Instant money transfer between individuals |

| Cryptocurrency Payments | Decentralized financial services |

Fintech is not just about new products. It’s about user experience. Simplified interfaces and real-time processing are key. Banks are partnering with fintech firms. Together, they create innovative solutions that redefine the financial landscape.

Security is paramount in digital transactions. Fintech brings advanced fraud detection and encryption methods. Customers and banks benefit from enhanced protection.

Consumer Behavior And Digital Payments

The way people spend money has changed. Today, more of us use phones and computers to pay for things. This shift in spending habits is big. Let’s see why people choose digital payments.

Trust And Perception Of Digital Payments

People need to feel safe when they pay online. Trust in technology and banks makes us okay with digital payments. We look for secure apps that protect our money. Companies work hard to make their systems safe. They want us to trust them with our cash.

The Convenience Factor: User Experience

Paying with a phone is easy and fast. Stores let us pay with a tap. We can shop online anytime. No need to carry cash or cards. It’s all about making shopping smooth and hassle-free. Good apps remember your details. They make buying things with one click possible.

- Quick checkouts save time

- Stores open 24/7 on your phone

- Pay bills or send money in seconds

Regulatory Landscape For Digital Payments

The world of financial transactions is rapidly evolving. Digital and mobile payments are at the forefront of this revolution. Understanding the regulatory landscape is crucial for businesses and consumers alike. It ensures compliance and fosters trust in these new payment systems.

Government Policies And Digital Currencies

Government policies shape the digital payment arena. They balance innovation with financial stability and consumer protection. Central banks and financial authorities craft regulations that impact how digital currencies operate.

- Legal Frameworks: Define the use of digital currencies.

- Anti-Money Laundering (AML): Rules prevent illegal transactions.

- Know Your Customer (KYC): Laws ensure customer identification.

Countries are exploring Central Bank Digital Currencies (CBDCs). These are digital forms of national currencies. They could change how we use money.

Data Privacy And Protection Laws

Data privacy is critical in digital payments. Personal information must stay safe. Protection laws vary by country, yet aim to safeguard user data.

| Region | Laws |

|---|---|

| Europe | General Data Protection Regulation (GDPR) |

| USA | California Consumer Privacy Act (CCPA) |

| Asia | Personal Data Protection Act (PDPA) |

These laws ensure that companies collect, store, and use data responsibly. Fines are levied for non-compliance. Consumers gain rights over their data.

Credit: www.bounteous.com

The Future Of Payments

The way we buy and sell is transforming. Digital and mobile payments are not just trends; they represent the future of transactions. This evolution is reshaping commerce, offering convenience and speed. Let’s explore what lies ahead in the realm of payments.

Predictions For Cashless Economies

- Cash transactions will drop as digital options grow more widespread.

- More countries will adopt digital currencies, like e-krona in Sweden.

- Biometric authentication will become common for secure transactions.

- Digital wallets will overshadow traditional ones, with users preferring smartphones over cash.

Challenges And Opportunities Ahead

The shift to digital payments isn’t without its hurdles. Security concerns and unequal access to technology are significant challenges. Yet, this shift also brings immense opportunity.

| Challenges | Opportunities |

|---|---|

| Data breaches | New markets for fintech innovations |

| Need for digital literacy | Increased transaction speed |

| Access to technology | Lower transaction costs |

Businesses can reach global customers with digital payments. They can also save on transaction fees and reduce the risks associated with handling cash. As for consumers, they enjoy unmatched convenience and a smoother shopping experience.

Frequently Asked Questions

When Did Digital Payments Become Popular?

Digital payments surged in popularity during the late 1990s and early 2000s with the growth of e-commerce and online banking.

Why Are Mobile Payments Popular?

Mobile payments offer convenience, speed, and enhanced security, making them a preferred choice for on-the-go transactions. They streamline purchases and reduce the need to carry cash or cards.

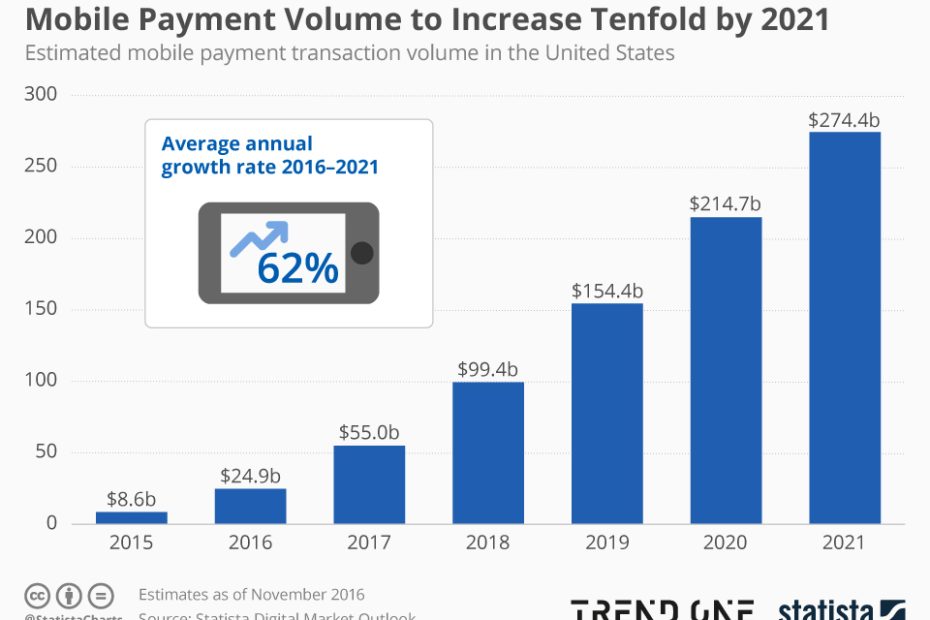

What Is The Growth Rate Of Mobile Payments?

The global mobile payments market is experiencing rapid growth, with an estimated annual increase of 30% from 2021 to 2026.

What Is The Future Of Mobile Payment Technology?

The future of mobile payment technology is geared towards increased security, faster processing, and wider global adoption, with innovations like biometric authentication and contactless transactions becoming standard.

Conclusion

Embracing digital and mobile payment systems marks a significant shift in transaction convenience and security. These technologies are rapidly transforming commerce, signaling a decline in traditional cash-based methods. As consumers and businesses alike adapt to this change, staying informed and agile is crucial.

The future of payments is here, and it’s digital. Join the revolution and simplify your transactions today.