The modernization of financial transactions necessitates a focus on security, efficiency, and innovation. Ensuring these areas are prioritized is crucial for the sustainability of financial systems.

The financial landscape is undergoing rapid transformation with the advent of new technologies and platforms. Consumers and businesses alike are shifting towards more digital and less traditional means of managing their finances. This shift brings with it a host of potential risks and opportunities.

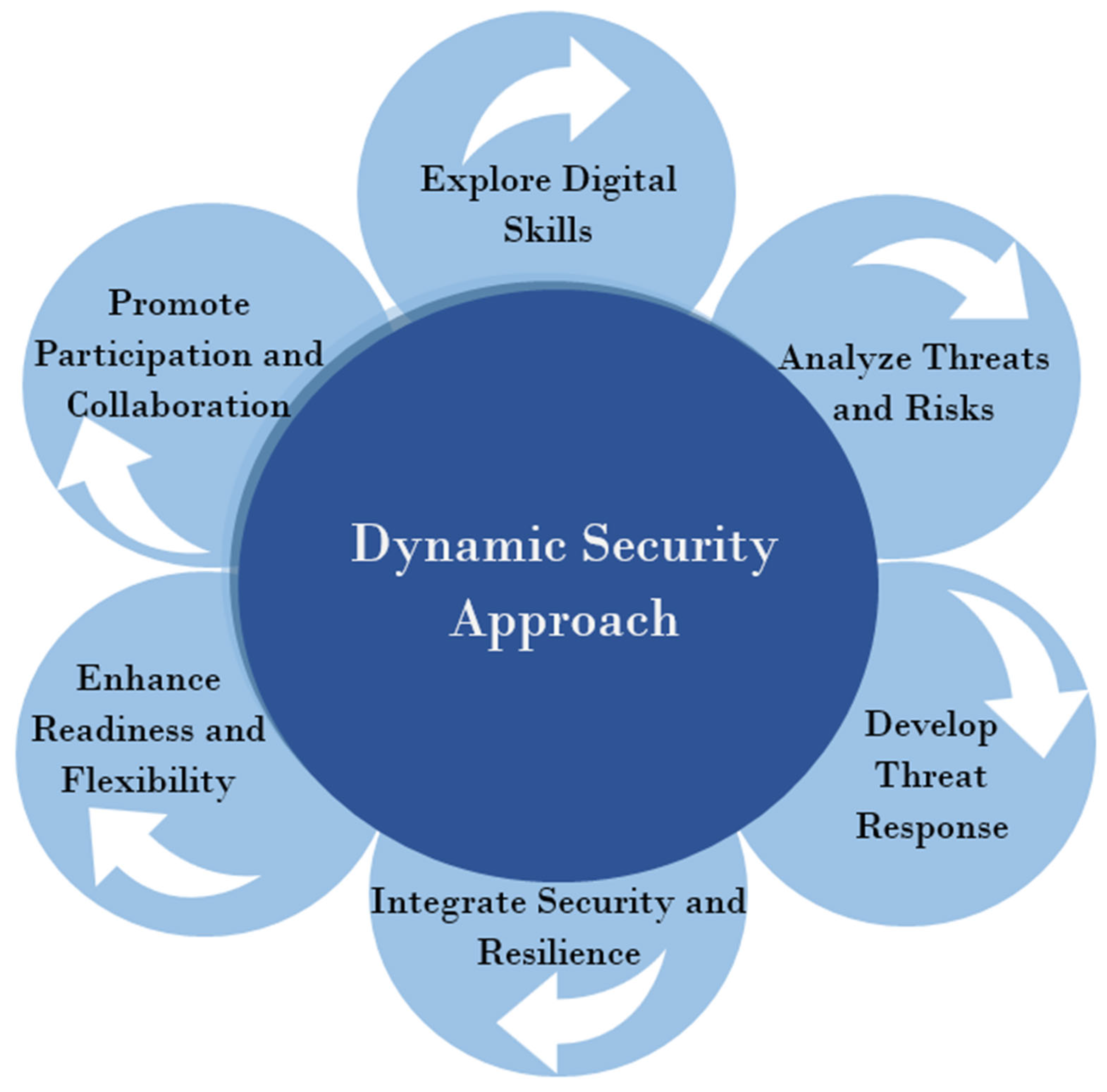

To navigate this evolving terrain, it is imperative to bolster security measures against increasing cyber threats. Simultaneously, enhancing efficiency remains a top priority to keep pace with the demand for instant and seamless transactions. Furthermore, fostering an environment conducive to innovation is essential for the development of cutting-edge financial solutions. These solutions can redefine how we interact with money and even lay the groundwork for future economic growth. As we delve deeper into the age of digital finance, striking a balance among these key areas will be the cornerstone of a robust financial ecosystem.

Introduction To Secure And Innovative Finance

In the digital era, finance is transforming at a rapid pace. With each leap forward, the balance between innovation and security becomes more critical. This section explores the dynamic world of finance and the crucial role of robust security measures in fostering groundbreaking financial solutions.

The Evolution Of Finance

- Barter to Blockchain: A journey from simple trade to complex digital transactions.

- Payment Methods: From coins to contactless, the way we pay is always changing.

- Global Economy: Finance knows no borders, and digital solutions reflect this shift.

Importance Of Security In Financial Innovation

| Area | Security Concerns | Security Measures |

|---|---|---|

| Online Banking | Hacking, Fraud | Encryption, Two-Factor Authentication |

| Mobile Payments | Theft, Unauthorized Access | Biometrics, Secure Elements |

| Investment Platforms | Data Breaches, Market Manipulation | Regulatory Compliance, AI Monitoring |

Credit: www.frontiersin.org

Key Principles Of Financial Security

Financial security stands as the backbone of economic growth and personal wealth. It’s essential to understand its key principles. With an ever-changing financial landscape, grasping these basics could mean the difference between thriving and falling behind. Let’s dive into the core of financial security, focusing on two pivotal components: risk management strategies and regulatory compliance.

Risk management strategiesRisk Management Strategies

Effective risk management is crucial for secure financial transactions. Organizations must identify potential risks and implement strategies to mitigate them.

- Regular audits track transaction authenticity.

- Encryption technologies protect data integrity.

- Employee training prevents human error.

These steps help build a robust defense against various financial threats, ensuring safety for both institutions and users.

Regulatory complianceRegulatory Compliance

Adherence to laws and regulations is non-negotiable. It safeguards the system’s integrity and customer trust.

- Stay updated on changes in financial laws.

- Implement controls to meet legal standards.

- Regular reviews ensure ongoing compliance.

Businesses that prioritize these practices are better equipped to navigate the complexities of the financial world, keeping operations smooth and secure.

Innovation In Finance: A Paradigm Shift

The financial world stands on the brink of a digital revolution. Innovation in finance reshapes how we interact with money, invest, and build wealth. This era of change brings new challenges and opportunities. We must focus on security, efficiency, and innovation to ride this wave successfully.

The Rise Of Fintech

Financial Technology, known as fintech, is changing the game. It offers tools that make transactions faster and more user-friendly. Fintech start-ups are challenging traditional banks, bringing fresh ideas to the table.

- Mobile banking apps simplify money management.

- Payment platforms make buying and selling easier.

- Robo-advisors democratize investment advice.

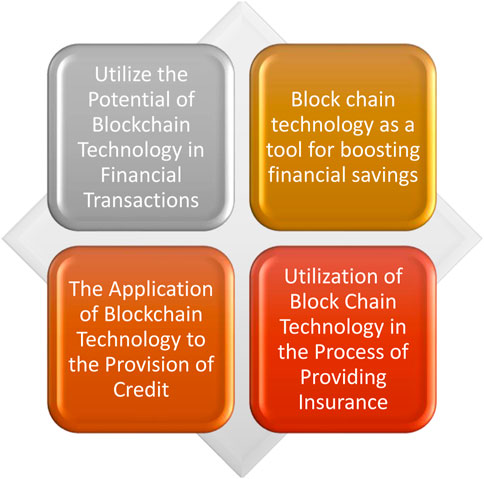

Blockchain And Finance

Blockchain technology is a cornerstone of modern finance. Its impact goes beyond cryptocurrencies. It offers a secure way to record transactions with transparency and speed.

| Feature | Benefit |

|---|---|

| Decentralization | Reduces single points of failure. |

| Immutability | Ensures data integrity. |

| Smart Contracts | Automates agreements, saving time and money. |

Challenges In Modern Financial Ecosystems

As the pulse of financial transactions quickens with innovation, the modern financial ecosystems face significant challenges. Security, efficiency, and the bright spark of innovation are the cornerstones of a robust financial sector. Yet, threading these elements together into a seamless tapestry presents its own set of hurdles.

Cybersecurity Threats

With digital advancements, cyber threats loom larger than ever. Attackers continually develop new methods to breach systems. Financial institutions must stay vigilant and proactive. Key points include:

- Data breaches: Sensitive information is at risk.

- Phishing attacks: These scams trick individuals into giving up personal data.

- Ransomware: It locks access to data until a ransom is paid.

Effective countermeasures are critical for trust and stability in finance.

Balancing Innovation With Regulation

Innovation drives progress but also brings complexity. Regulations aim to protect consumers and maintain order. The challenge lies in:

- Adapting to new technologies: Regulations must evolve without stifling innovation.

- Global alignment: Different countries have varied regulations, complicating international finance.

- Risk management: New products must be assessed for potential risks.

Striking the right balance is essential for a healthy financial future.

Technologies Driving Secure Finance

In the dynamic landscape of financial transactions, security and efficiency are paramount. Innovative technologies are at the forefront of driving secure finance. Let’s explore the key tech players in this field.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing financial security. These technologies detect and prevent fraud before it happens. They analyze vast amounts of data and recognize patterns that humans can’t.

- Real-time fraud detection: AI algorithms monitor transactions. They flag unusual activity instantly.

- Personalized security measures: Machine Learning tailors security protocols to user behavior.

- Risk management: AI evaluates risks in financial operations. It helps in making informed decisions.

Secure Payment Gateways

Secure payment gateways protect sensitive financial information. They are essential for online transactions. Gateways use encryption and other security protocols to safeguard data.

| Feature | Benefit |

|---|---|

| Encryption | Keeps data hidden from hackers |

| Tokenization | Replaces sensitive info with unique symbols |

| Secure Socket Layer (SSL) | Creates a secure link between the website and the user |

These gateways comply with international standards. They ensure a safe environment for users to transact with peace of mind.

The Role Of Data Privacy

In the digital age, data privacy stands as a cornerstone in managing financial transactions. The surge in online activity demands robust measures to safeguard sensitive data. Users expect their financial details to remain secure and private. This trust is crucial for the evolution of financial systems.

Protecting Consumer Information

Security protocols are the shields of consumer data. They defend against unauthorized access. Encryption and multi-factor authentication play key roles. Financial institutions must prioritize these tools to protect customer information.

- Encryption scrambles data, making it unreadable to intruders.

- Multi-factor authentication adds extra security layers.

Regular security audits are essential. They ensure ongoing protection and trust.

Data Breach Prevention

Preventing data breaches is non-negotiable. It requires a proactive approach. Continuous monitoring and real-time threat detection are vital.

| Strategy | Action |

|---|---|

| Monitoring | Track unusual activity around the clock. |

| Software Updates | Install patches to fix security gaps promptly. |

Employee training reinforces these strategies. Staff must recognize and respond to threats effectively. This collective effort helps shield financial data from cyber threats.

Case Studies: Successes And Failures

The digital age has transformed financial transactions. This shift demands a closer look at the twin pillars of progress: security and innovation. Through case studies of fintech success stories and infamous security breaches, we can distill vital lessons. These insights shape a safer and more dynamic financial landscape.

Successful Secure Fintech Startups

Startups in fintech are redefining secure transactions. They blend cutting-edge technology with robust security measures. Let’s spotlight a few that have set benchmarks for success.

- Stripe: Revolutionized online payments with state-of-the-art encryption.

- Square: Made mobile transactions safe with real-time monitoring systems.

- Adyen: Offers a single platform solution with strong fraud protection features.

These companies excel by prioritizing customer trust. They do this through seamless and secure services.

Lessons Learned From Financial Breaches

Financial breaches are stark reminders of security needs. They teach valuable lessons for the industry’s future.

| Breach Case | Impact | Lesson |

|---|---|---|

| Equifax (2017): | Exposed personal data of millions. | Importance of data encryption. |

| Capital One (2019): | Leaked sensitive customer information. | Need for robust access controls. |

| Target (2013): | Compromised payment card details. | Value of secure payment systems. |

Each case underscores a specific area for improvement. Breaches drive the fintech industry to enhance security protocols and innovate safely.

Future Trends In Secure Financial Services

As we navigate the digital age, secure financial services are more crucial than ever. The landscape of financial transactions is shifting. With these changes, we must focus on security, efficiency, and innovation. Let’s explore the future trends in this evolving sector.

Predicting The Next Big Thing In Fintech

Fintech evolution is unstoppable. New technologies emerge regularly. Understanding these trends helps us prepare for a secure financial future. Below, we outline several key advancements:

- Blockchain: More than cryptocurrency, it’s a security backbone.

- AI and ML: These tools fight fraud, learn patterns, and protect users.

- Biometrics: Fingerprints and facial recognition add a security layer.

Each innovation leads to safer transactions. They also open doors for new services.

Regulatory Outlook And Potential Impacts

Regulations shape fintech’s path. They ensure consumer protection and market stability. Upcoming regulations may:

| Regulation Area | Impact on Fintech |

|---|---|

| Data Privacy | Increases user trust and security |

| Payment Services | Standardizes transaction processing |

| Cross-border Transactions | Facilitates global trade |

Staying ahead of these changes is key. It ensures fintech growth and user protection.

Creating A Secure Thesis On Finance

Creating a Secure Thesis on Finance is a pivotal step for students and researchers alike. The rise of digital financial transactions demands a deep dive into security, efficiency, and innovation. Crafting a well-structured, original thesis can influence the financial sector significantly. Let’s explore how to build a robust foundation for research in this evolving landscape.

Structuring Your Research

Effective research begins with a solid structure. Begin with a clear outline. This serves as your roadmap. Ensure each section flows logically to the next. Use tables to organize data succinctly.

| Section | Content |

|---|---|

| Introduction | State the thesis and objectives. |

| Literature Review | Analyze existing work. |

| Methodology | Describe your approach. |

| Analysis | Discuss findings. |

| Conclusion | Summarize the research. |

Ensuring The Originality And Relevance

Originality sets your thesis apart. Use plagiarism checkers to verify uniqueness. Relevance means your research must address current issues. Employ bullet points to list down key areas:

- Emerging threats in financial security

- Innovative transaction methods

- Regulatory changes and their impacts

- Technological advancements shaping finance

Conduct surveys, interviews, or use case studies to add depth. Cite sources in the correct format to give credit to original authors. This builds credibility and shows dedication to scholarly rigor.

Credit: www.mdpi.com

Conclusion: The Balance Of Innovation And Security

The dance between innovation and security in financial transactions is intricate. Both elements must move in harmony to create a safe and progressive financial landscape. Let’s explore the balance needed to keep finance secure and innovative.

Summarizing Key Takeaways

- Security measures are the backbone of trust in financial systems.

- Innovative solutions drive progress and user convenience.

- Striking a balance is critical for long-term success in finance.

The Future Of Secure And Innovative Finance

Looking ahead, the focus on cutting-edge security will remain steadfast. Technologies like biometrics and blockchain will lead the charge. Users can expect smoother transactions with top-tier protection.

| Aspect | Role in Finance |

|---|---|

| Security Protocols | Guard user data and funds |

| Payment Technologies | Enhance user experience |

| Regulatory Policies | Ensure compliance and fairness |

Through collaborative efforts and smart policies, secure and innovative finance can flourish together. The future is bright for those who invest in both.

Credit: www.mdpi.com

Frequently Asked Questions

How Do The Financial Services Described Here Use Information Technology To Innovate?

Financial services innovate using information technology by implementing advanced data analytics, enhancing cybersecurity, and adopting blockchain for secure transactions. They also leverage mobile banking apps for customer convenience and use AI for personalized financial advice.

What Is A Good Thesis Statement About Technology?

A good thesis statement about technology might be: “Technology has revolutionized the way we communicate, work, and learn, driving society’s progress but also presenting ethical challenges that must be addressed. “

How Does Fintech Contribute To Market Efficiency?

FinTech streamlines transactions, reducing costs and increasing speed. It introduces innovative payment systems and algorithms that enhance decision-making and market predictability. Through automation, FinTech also minimizes human error, boosting overall market efficiency.

What Are The Key Points And Success Factors In Digital Transformation Strategies For Organizations Deploying Digital Solutions?

Key digital transformation success factors include clear leadership, customer-focused strategy, agile methodology, data-driven decision-making, and robust cybersecurity measures.

Conclusion

Embracing the dynamic nature of financial transactions requires vigilance. Secure, efficient, and innovative practices are non-negotiable for industry growth. As we adapt to new financial landscapes, prioritizing these aspects ensures a robust economic future. Let’s commit to excellence in our financial endeavors.